By Subhajit Bhattacharya, ENN

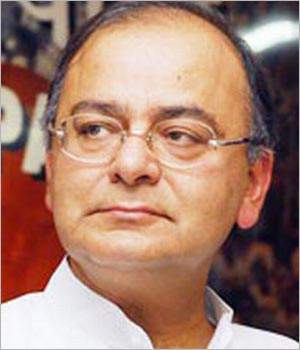

Eastern zone got its first commercial bank since Independence when Union Finance Minister Arun Jaitley inaugurated ‘Bandhan Bank’ at the Science City Auditorium in Kolkata on Monday.

“West Bengal was once known for producing several intellectuals, but few entrepreneurs. The launch of Bandhan Bank will not just boost the growth of Bangla entrepreneurs, but also signifies the return of entrepreneurs to Bengal,” Jaitley said addressing the gathering.

Post Independence, Bandhan is the first bank in the zone, which got clearance from the RBI and the Government of India to start its nation-wide commercial operations. It came into being with its state-of-the-art financial activities targeting the weaker sections of the society, and soon evolved into a massive micro-finance company with its branches across the country.

Incidentally, Bandhan is the only micro-finance company of India that has successfully transformed itself into a universal bank.

It started its journey in the year 2001 as an NGO working towards the cause of poverty elimination and all-round development of women. Later, in the year 2006, it transformed itself into a non-banking financial organisation.

“Bandhan started its trail with twin objectives of poverty eradication and women empowerment. With a record repayment of 99 per cent, the institution has successfully fulfilled its objectives,” said West Bengal Finance Minister Dr Amit Mitra speaking on the occasion.

Bandhan will concentrate entirely on the eastern part of India. It plans to open 200 branches in West Bengal, followed by 67 in Bihar, 60 in Assam, 21 in Maharashtra, 20 each in Tripura and Uttar Pradesh and 15 in Jharkhand. The bank will have two separate headquarters in Kolkata, one for micro-finance and the other for general banking. CEO, MD and Founder of the Bank Chandra Shekhar Ghosh, vowed to change the banking system of India with this new innovative banking.

“We always believed in the ‘customer first’ business philosophy and we are a universal bank having equal respect for our customers, whether he or she is big or small. Bandhan family is dedicated to provide the fundamental banking rights to all the citizens of India,” he said.

Bandhan is foraying into the Indian banking domain with more than 1.43 crore accounts and 10,500 crore loan books, along with more than 19,000 employees. It will start operating in the country with more than 501 branches and 2,000 service centers and ATMs spread across 24 states.

Further, the Bank wants to consolidate its presence in the market with concrete planning. It has plans to take the count of its ATMs to 250 and the number of branches to 632 by the end of the fiscal year 2016. “The Bank will stick to its motto of serving rural India. More than 70 per cent of Bandhan Bank branches will target the customers of the rural India and rest 35 per cent will cater to the urban customers of India,” an exuberant Ghosh stated.

Experts feel that since a massive population of India lives away from the mainstream financial infrastructure of the country, it is not only affecting the rural economy of India, but also adversely telling on the GDP of the country. After the launch of the Prime Minister Narendra Modi’s pet project, Jan Dhan Yojna, more than 17 million bank accounts were opened, which has bolstered the entire banking system of India and brought millions of uncovered customers under the banking umbrella. Financial pundits predict that the banking asset of India will grow manifolds to reach USD 28.5 trillion by 2024-25, and that banks like Bandhan will definitely play a pivotal role in this growth.

At present, there are plethora of banks, which include several foreign, co-operative and nationalised banks competing to grab the potential customers of the Indian market. Amongst many, the State Bank of India holds the largest chunk of customers in its closet.

The Bandhan Bank got some preferences from the RBI on sympathetic grounds and got its nod by depositing a capital of Rs 2,570 crore against the standard capital amount of Rs 500 crore. Interest rates for the savings bank account have been kept above four per cent for the balance of one lakh rupees and for balance above Rs 1 lakh, it is five per cent.

“To fuel the growth of East India, the Centre will implement all possible strategies by forgetting all political differences,” assured Jaitley. The Union Finance Minister opined that the growth of states like Uttar Pradesh, west Bengal, Odisha and other north-eastern states will contribute hugely to the growth of the GDP of the nation.

RBI Deputy Governor H R Khan, who was also present on the dais, said, “Bandhan is born at a very critical time of the Indian economy. It is entering the market with another 11 payment banks and one universal bank…that makes the Indian Banking sector somewhat crowded at the moment.”

The Bank got its initial approval from the RBI in 2014 and got its final nod from the central bank in the month of July 2015. A number of entities invested in this newly-formed bank, including IFC, SIDBI, Caladium Investment Pte Ltd, etc.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/