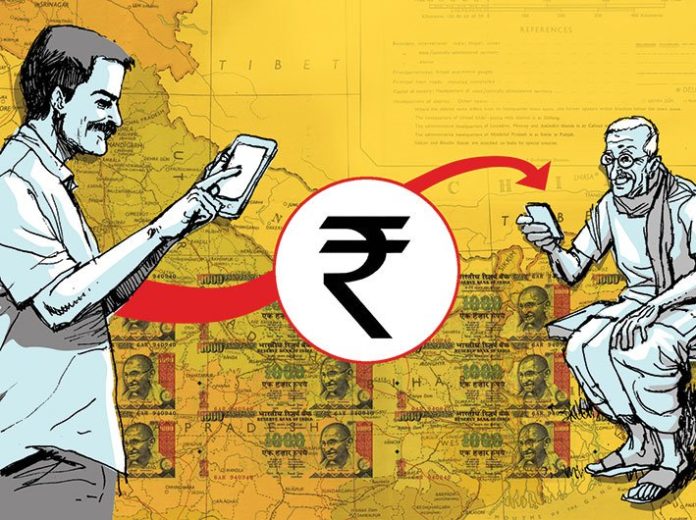

For promoting the usage of cashless transactions in the public distribution system (PDS), Rajasthan government has requested the Centre for waving different types of financial charges on Aadhaar-enabled payment system (AePS).

For promoting the usage of cashless transactions in the public distribution system (PDS), Rajasthan government has requested the Centre for waving different types of financial charges on Aadhaar-enabled payment system (AePS).

Reportedly, the state has also requested the Centre to ask the telecom service providers to ensure better connectivity at 135 locations where point of scale (PoS) devices don’t work.

Rajasthan chief secretary OP Meena has written to the union finance ministry to either waive financial charges -transaction, authentication and synchronisation charges – levied by the National Payments Corporation of India (NPCI) and banks or bear them itself, reported the Hindustan Times.

“In Rajasthan, 1.25 crore transactions are done through PoS devices every month. It would not be advisable to pass on these charges to either beneficiaries or the FPS (fair price shop) dealers as this would hamper the process of digital payments. The state government is also in no position to bear these charges,” the letter said.

“Alternately, the financial burden of these charges may be borne by GoI to facilitate AePS model in PDS,” the chief secretary suggested in his letter.

Rajasthan decided to adopt the AePS as it seems to be the most feasible model considering the fact that the FPS in the state already has been equipped with PoS machines with biometric scanners and for this model, neither the dealer nor the beneficiary is required to have a smartphone.

For all other digital payment models – such as e-wallet, unified payment interface (UPI) and net banking – a smartphone is needed for completing the transaction.

The issue of financial charges on digital payments was raised at a workshop of food ministers and food secretaries in New Delhi on January 19, 2017, the letter notes.

In Rajasthan, the state leading in FPS automation, 24,724 PoS devices have been installed at FPS but 135 of them don’t function because of lack of connectivity. The FPSs at these locations are distributing PDS commodities manually without biometric verification.

“The state has written to the Union food and PDS department to ensure connectivity at these locations for “compliance of directions of Government of India on FPS automation,” said Subodh Agarwal, Rajasthan’s principal secretary of food and civil supplies department.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/