Remittances from the Indians staying abroad have been the country’s traditional source of enriching the foreign currency reserves, with the World Bank suggesting that Indians abroad will remit a whopping $72 billion by the year-end.

Remittances from the Indians staying abroad have been the country’s traditional source of enriching the foreign currency reserves, with the World Bank suggesting that Indians abroad will remit a whopping $72 billion by the year-end.

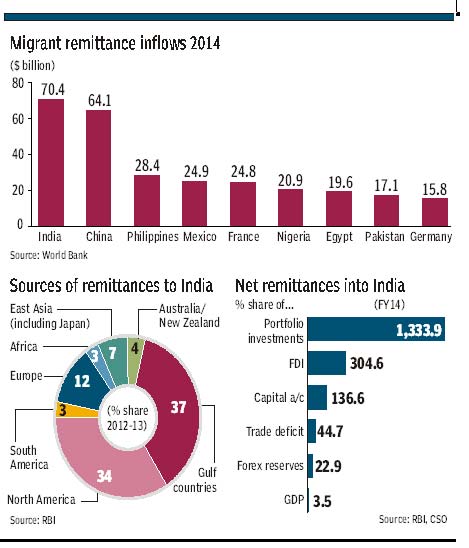

This figure is 2.5 per cent more than the previous year, giving India an edge over countries like China and Philippines, which occupy second ($64 billion) and third ($30 billion) position, respectively, in remittances. The World Bank also sees the remittances growing further for India in 2016.

One major factor, according to the Bank, hindering the growth of sending in money is the high cost of remittance involved, nearing 7.7 per cent, globally. In fact, a number of start-up companies into the remittance service space eat away a sizeable part of the money thus sent in.

The hidden costs in FX spread – the difference between an inter-bank currency conversion rate and the rate quoted to you by a bank or money transfer company – will thus eat away more than five billion dollars from the remittance money coming to India this year.

Instarem, which got a licence to do remittances from Australia in November last year, saw its transfers to India cross a monthly volume of A$2 million ($1.43 million) in September. Last month it opened up new corridors from Australia to the Philippines, Indonesia, Sri Lanka, and Singapore. It aims to be in Vietnam and Bangladesh by the end of the year.

Experts believe that if the government agencies can rein in the remittance service providers a little, the forex scenario can improve substantially, especially in Asian countries.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/