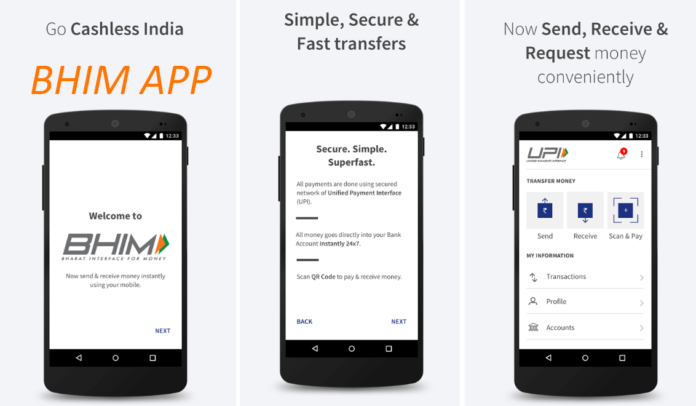

In tune with the digital India dream, the government has enabled the Bharat Interface for Mobile (BHIM) app with Aadhaar.

In tune with the digital India dream, the government has enabled the Bharat Interface for Mobile (BHIM) app with Aadhaar.

Furthermore, the government has planned to launch the biometric-based Aadhaar Pay payment module in the coming weeks, reported the Economic Times.

Aadhaar Pay service will help people to make and receive payments using their Aadhaar number and the biometric technology. This service will prevent the need to carry mobile phones for making payments.

“As of now, 14 banks have come on board for Aadhaar Pay and the government is in talks with other banks too,” Minister for Electronics and IT, said Ravi Shankar Prasad.

He added, “We are going to start Aadhaar Pay. With this, people will not require to carry their phone for payments. They can visit any merchant, share their Aadhaar number and verify themselves using biometrics to pay and receive money.”

Aadhaar has already issued unique numbers to 1.11 billion people in the country, and about 390 million bank accounts are now linked to the 12-digit Aadhaar number.

“We are going to start Aadhaar Pay. With this, people will not require to carry their phone for payments. They can visit any merchant, share their Aadhaar number and verify themselves using biometrics to pay and receive money,” Prasad added.

Aadhaar has already issued unique numbers to 1.11 billion people in the country, and about 390 million bank accounts are linked to the 12-digit Aadhaar number.

Transactions where Aadhaar is listed as a payment ID on the BHIM app will not require any biometric authentication or prior registration with the bank or UPI.

BHIM allows sending money to a mobile number but the receiver is required to be registered with the UPI to accept payment. In turn, the long process of generating a UPI PIN by entering debit card details may discourage the poor and those lacking in literacy.

There are five payment options on the BHIM app, including the mobile number, bank account and the IFSC code. The Aadhaar number will be the sixth such option.

“It (Aadhar) has come a long way in less than six and a half years of its journey from being a unique identification (UID) programme to transforming itself into a critical development tool of public-centric good governance and targeted delivery of services, benefits and subsidies,” he said.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/