Economic climate of South India has shown a promising growth in comparison to the rest of India. A study has suggested six states of South India – Andhra Pradesh, Karnataka, Kerala, Puducherry, Telangana and Tamil Nadu are projected to become $1,200 billion economy by 2020. Rashi Aditi Ghosh of Elets News Network (ENN) explores how the second largest market in India is expanding in terms of the banking and financial sector.

Banking density in southern India is higher than rest of the India. According to Society of Automobile Manufacturers (SIAM), the South accounts for 28 per cent of bank branches in rural and semi-urban areas in India.

Banking density in southern India is higher than rest of the India. According to Society of Automobile Manufacturers (SIAM), the South accounts for 28 per cent of bank branches in rural and semi-urban areas in India.

During demonetisation, out of more than 2,00,000 cash dispensers across the country, a third were located in south India, according to statistics of the Reserve Bank of India.

Experts ascribed several reasons to the southern surge. The degree of demonetisation’s impact is linked to banking density, which is higher in the south.

Explaining the growing popularity of South India interms of banking and financial services, said Suresh Rajagopal, President, Software Business, FSS “Since India is considered to have 21 per cent of the world’s unbanked population, the nascent fintech industry in India is expected to grow bigger. South India in particular, focuses on savings as well as managing their investments.”

“In addition, South India market comprises of Public Sector Banks, Old Generation Private Banks and the Small Finance Banks. South India as a market – which is the second largest in India is keen to adopt the latest Digital Banking Technologies to service its customers and focuses on solutions which would generate revenues to the bank . It is cost conscious and seeks ways and means to arrive at an economical cost for the solutions to be deployed,” he added.

South India, a Popular Choice for BFSI Sector

Experts opine that South India is a very important market for banking and financial industry as it has a vibrant corporate and retail business environment.

“We see huge potential in South India especially in the adoption of financial inclusion. With MoneyOnMobile’s extensive pan-India retailer network, we provide financial services to meet customer requirements by transforming the Cash Experience for the unbanked, underbanked or even to customers who reside in the remotest part of the country. We currently have 3,50,000 retailers pan-India with around 14,000 retailers concentrated in South India. It is our constant endeavour to continue to expand our financial network across the region and the country”, said Harold Montgomery, Chairman and CEO, MoneyOnMobile.

“We see huge potential in South India especially in the adoption of financial inclusion. With MoneyOnMobile’s extensive pan-India retailer network, we provide financial services to meet customer requirements by transforming the Cash Experience for the unbanked, underbanked or even to customers who reside in the remotest part of the country. We currently have 3,50,000 retailers pan-India with around 14,000 retailers concentrated in South India. It is our constant endeavour to continue to expand our financial network across the region and the country”, said Harold Montgomery, Chairman and CEO, MoneyOnMobile.

Six regions of South India i.e Andhra Pradesh, Karnataka, Kerala, Puducherry, Telangana and Tamil Nadu when put together are among the top 30 economies of the world, contributing over 22 percent of India’s GDP and 28 percent of India’s employment.

Chennai is the hub of automobiles, Hyderabad and Bengaluru are Information Technology (IT) hubs and Kerala is a strong market for bancassurance. In retail, obviously motor and health insurance are the dominant products. In corporate, in addition to property Insurance, liability lines are also very popular amongst the automobile and IT sectors.

“It is a unique market in the sense that customers tend to continue with their existing insurers for long period, thus signifying loyalty and commitment. Bajaj Allianz General Insurance is a strong player in this market with very good market share in Chennai, Hyderabad and Bengaluru. This part of the country has always been a stronghold for us in both retail and corporate business,” said T A Ramalingam, Chief Distribution Officer, Institutional Sales, Bajaj Allianz General Insurance, while speaking about South India in terms of insurance market.

According to Care Ratings Report, South India forms around 56 per cent of the total education loan portfolio of the banks. Tamil Nadu and Kerala together account for 36 per cent of the outstanding education loan portfolio. Other states which account for a major chunk of the education loan portfolio include Maharashtra, Karnataka, Andhra Pradesh and Telangana.

“The literacy rate in South India is considerably higher than North India, which makes it conducive for banking. South India is also the hub for start-ups and technology incubators. The cultural idiosyncrasy and the general mindset of the people of South India make it ideal for exploring newer forms of banking in the South,” said Abhishek Pandit, Director, Business Services, AISECT.

Digital Payments –The Future of BFSI sector

E-payments are gaining a lot of popularity in India due to initiatives like Digital India, Unified Payments Interface, BHIM app, mobile wallets and many others. The segment gained a lot of momentum post the unveil demonetisation drive by Prime Minister Narendra Modi-led government in 2016.

Research study suggests that South India has a lot of scope in terms of digital payments as well.

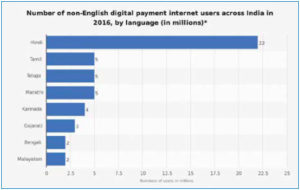

According to a KPMG report titled “Indian Languages: Defining India’s Internet” the number of regional internet users adopting digital payments is expected to grow by four times to 175 million by 2021 from just 47 million in 2016.

Telugu and Kannada speakers at 37 percent, followed by Tamilians at 36 percent, are the highest digital payments users among non-English internet users across India, reveals the KPMG study.

According to KPMG, Telugu and Kannada speakers at 37 percent, followed by Tamilians at 36 percent, are the highest digital payments users among non-English internet users across India.

“Language barrier is one of the challenges that a financial institution has to face while expanding to greener pastures in the South. Technology plays an important role in creating a seamless customer interface across all regions. AEPS and other Aadhaar based intervention have helped the banking system in authentication. App based banking services have taken the banks to customers’ home,” said Pandit from AISECT.

The report further suggests that in next three years, digital payment adoption rates of internet users whose speak Telugu, Kannada and Tamil are expected to rise to 53 percent, 55 percent and 55 percent, respectively. Also, there is an untapped opportunity in speakers of other regional languages such as Bengali whose digital payment adoption rate stands at 9 percent.

“FSS has been crafting a compelling payments strategy through its domain experience gathered over 27+ years across products, services and infrastructure to give payments business a winning strategy. At FSS, we map consumer expectations with payment initiatives that makes transactions simple, fast and secure. Some of our offerings are – digital banking services viz., Toggle, Green PIN , UPI , QR Code , Internet Payment Gateway Services and mobile banking services. In addition, we run a Transaction Switch for Switching ATM, POS transactions and provide end to end ATM Managed Services to various banks on 24×7 x365 basis from our data center in Chennai. Further FSS has licensed its IP Owned products like Debit Card Management, Reconciliation, ATM Monitoring to the Banks in South India,” said Rajagopal from FSS.

He further added, “In fact, we can proudly say that the first South India ATM (Indian Bank) is owned by us. FSS understands the challenges that financial institutions, banks, merchants, and payment processors face when it comes to enhancing revenues, improving efficiency, managing risk and expanding customer relationships.

“That’s why we’ve tailored our products to address the unique payments needs of our customers. In addition, our comprehensive suite of products focuses on making payments simple, secure, efficient and inclusive through continuous innovation. Our product portfolio spans the entire payment ecosystem.”

According to Society of Automobile Manufacturers (SIAM), South accounts for 28 per cent of bank branches in rural and semi-urban areas in India.

Among regional language speakers in 2016, Tamil had the highest internet adoption levels at 42 percent followed by Hindi and Kannada at 39 percent and 37 percent, respectively. Internet adoption among Telugu speakers stood at 31 percent.

Among regional language speakers in 2016, Tamil had the highest internet adoption levels at 42 percent followed by Hindi and Kannada at 39 percent and 37 percent, respectively. Internet adoption among Telugu speakers stood at 31 percent.

“Banks are working hard to strengthen customer relationships across channels, identify digital initiatives worth investing and conduct smart experiments. They look at digitising the entire customer journey and routes by developing new ways of banking which are novel and diverse,” said Rajagopal from FSS.

“In addition, recent partnerships between FinTech companies and traditional banks clearly suggest that two entities are collaborating to bring about customercentric approach in emerging and rapidgrowth markets like South India. These initiatives have transformed the entire traditional outlook of South India,” he added.

With several Start-up brands and IT sector investments, South India in particular is becoming a popular choice for industries across the globe. Banking, Financial Services and Insurance (BFSI) sector in particular sees a lot of scope in this part of country, which has a Gross Development Product (GDP) of over $300 billion.

Six regions of South India i.e Andhra Pradesh, Karnataka, Kerala, Pondicherry, Telangana and Tamil Nadu when put together are among the top 30 economies of the world, contributing over 22 percent of India’s GDP and 28 percent of India’s employment.

According to the British South India Council of Commerce, South India in the next three years i.e. by 2020 will become $1,200 billion economy.

BSICC is a platform for the India and UK business community to enhance their business activity as well as support businesses which are exploring opportunities in South India and UK.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/