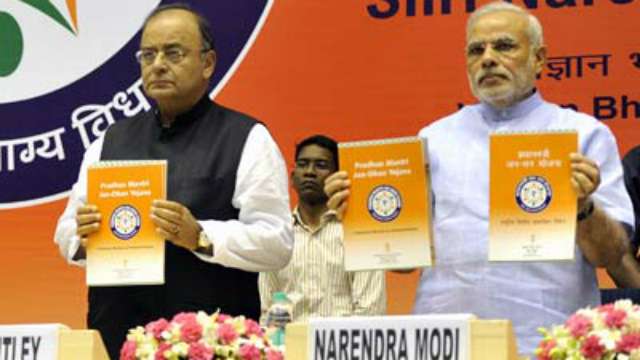

Promoting financial literacy and setting up bricks and mortar financial institutions every 5 kms for ease of credit and insurance products is the way forward for PM’s Jan-Dhan Yojana, Dr Aruna Sharma, Additional Chief Secretary – Panchayat, Rural Development & Social Justice, Govt of Madhya Pradesh, tells Gautam Debroy of Elets News Network (ENN)

What steps have been taken by the Madhya Pradesh Government towards a comprehensive financial inclusion (FI)?

The State of Madhya Pradesh has defined financial inclusion as a holistic approach focussed on access to financial services. Thus, it is not restricted to just opening an account but to ensure that the BC points/USBs/CSPs (Business Correspondents points/Ultra Small Bank/Customer Service Points) are opened in bricks and mortar. Space of 100 sq ft is offered free of cost in e-Panchayat rooms. It is mandatory to have name plates bearing names of bank branches and villages within the 5km radius it would serve. Thus, all financial institutions have their service area of 5km radius. Post offices are also being counted till the time BC points/USBs/CSPs become operative and proper banks are in place. Cooperative Bank being in core banking, it also caters to FI process.

The next mandatory step is to have the account number seeded in the common database of the State, i.e. Samagra Database. Thus, for any G2P scheme, the account number of the beneficiary, along with the IFSC code, is available. Samagra Database enables cross-checking entitlement and G2P transactions. In 2013-14 fiscal, such transactions stood at `7,319 crore covering MGNREGA, scholarships spread across several departments, PDS system entitlements, housing, pensions, etc. Thus, the State is targeting for a holistic model. The focus is on financial literacy, ease of getting credit etc.

Tell us about the Samagra Samajik Suraksha Mission.

The Samagra Samajik Suraksha Mission (SSSM) is a common database using census data as the base data. The database, prepared on the basis of door-to-door survey, has details of families. Therefore, SSSM gives each family a unique Family ID and individual ID number. This helps know the entitlements of a specific family. This has also check duplication. Nearly Rs350 crore has been saved in scholarships and 4 lakh pensions have been stopped. This database also helps in knowing the number of members of a family for PDS. Housing and sanitation is linked to the Samagra Family ID, thus preventing duplication.

Also Read: PMJDY will Take Benefits to Last Man: K P Bakshi

What initiatives have been undertaken by the State Government for ‘Samruddhi’ (prosperity) of the people at large?

There is a need to work out ‘Samruddhi’ line instead of talking about poverty line. The State is working out the details, like number of families with pucca houses, children going to school and not resorting to child labour, immunisation, drinking water etc. This will take people up the prosperity ladder. This is the concept, we are trying to evolve through our ‘Samruddhi’ plan.

Have you fixed any time frame for achieving comprehensive financial inclusion?

Under the PM’s Jan-Dhan Yojana programme, majority of the people have opened accounts. The target, there therefore, is to make all the BC points operative. Already 2,415 are fully functional and another 2,000 in the offing. Thus, entire geographical area of the State is covered.

Now, post-office (non-core banking) areas are to be replaced with banks, which will be complete very soon. But, financial inclusion in holistic manner will require to have on offer products like credit, insurance and their access to the account holders. RuPay debit cards with Samagra Family ID, individual ID and Aadhaar number wherever available have already been approved by NPCI (National Payment Corporation of India) and is being issued. We are first State that will have name of beneficiary in vernacular i.e. Hindi, as well. This task is targeted to be completed in the coming financial year with more and more departments joining with their G2P schemes.

Under the Pradhan Mantri Jan- Dhan Yojana programme, majority of the people have already opened accounts. The target is to make all the Business Correspondent points operative

What policy-related suggestions would you make to push financial inclusion in the country?

The next step in the Pradhan Mantri Jan-Dhan Yojana is to ensure bricks and mortar financial institutions every 5 kms. Financial literacy with ease of credit and good stable insurance products is the way forward. If post offices are brought into core banking, it will give a boost as they have all financial products to accept credit. Mini banking licences will go a long way in promoting financial inclusion.

Also Read: Maharashtra to Take PMJDY to Next Level:Shree Kant Singh

How do you operate the DBT scheme in Madhya Pradesh?

As of now, using Samagra Database, already MGNREGA, Housing, Pensions, Scholarships etc., have been brought in DBT mode, i.e. straight from State Government account to the accounts of beneficiaries. More such schemes are dovetailing the same. This enables immediate disbursement and avoids parking of funds in various accounts. Under the system, departments draw required fund from the state treasury into their accounts and from there disburse directly into the accounts of beneficiaries.

What is the status of Swachha Bharat Mission in your State?

There is a long way to go. This is one scheme where there is more of ‘push’ factor than the ‘pull’ factor. The ODF (open defecation-free) villages/panchayats tend to slip and, hence, there is a constant effort to awareness building. The strategy is to link ODF with the dignity of women and, hence, called ‘Maryada Abhiyan’. The efforts are also on to ensure that demand is created to have toilets. Under ‘Panch Parmeshwar’ plan, enough funds are made available to panchayats, which has resulted in more than 2-3 lanes in every village being already covered with concrete structures having drainage facility. Thus, village/panchayat is motivated to maintain hygiene by having toilets at home, school, Anganwadis, etc., and maintain cleanliness and solidliquid waste management.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/