The centre on Monday gave its nod to the revision in the definition of MSMEs for further improvement in their ease of doing business. For micro-enterprises, the limit for investment and turnover was improved to Rs 1 crore and Rs 5 crore respectively.

On the other hand, for small enterprises, the investment and turnover limit has been increased from Rs 1 crore and Rs 5 crore respectively to Rs 10 crore and Rs 50 crore.

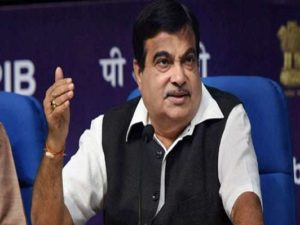

Similarly, for medium enterprises, the limit for investment has been inflated to Rs 50 crore and for turnover, the limit was hiked to Rs 250 crore. Following announcement were made during a press briefing addressed by environment minister Prakash Javadekar, MSME minister Nitin Gadkari and agriculture minister Narendra Singh Tomar.

Similarly, for medium enterprises, the limit for investment has been inflated to Rs 50 crore and for turnover, the limit was hiked to Rs 250 crore. Following announcement were made during a press briefing addressed by environment minister Prakash Javadekar, MSME minister Nitin Gadkari and agriculture minister Narendra Singh Tomar.

Besides, Cabinet has also cleared the Rs 50,000 crore equity scheme for MSMEs, which was revealed by the Finance Minister Nirmala Sitharaman earlier this month during her four day long economic package announcement, with a Fund of Funds corpus of Rs 10,000. The scheme will also be encouraging MSMEs to get listed on the stock exchanges. The Fund of Funds will be operated via mother fund and few daughter funds.

The revision in definition was announced by Union Finance Minister as part of the economic package.

MSME Minister Gadkari had recently said that a committee has been appointed by Prime Minister Narendra Modi to be chaired by Rajnath Singh for resolving any problem pertaining to the implementation of the Rs 3 lakh crore collateral-free loan scheme for MSMEs.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/