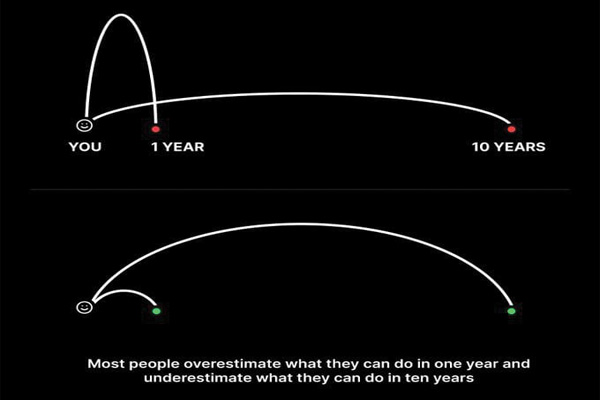

AI backed with hybrid cloud in BFSI – can provide scalability, sustainability and agility. Cross-selling, the customer experience blossoms at a superior pace. A wise choice is when AI is seen with a view of 5 to 10 years and business strategy aligned rather than short vision. To know more about next-gen analytics, Rashi Aditi Ghosh of Elets News Network (ENN) had a conversation with Shivakumar Nandipati, Chief Digital Officer, Fedfina.

How significant is the role of data analytics and AI in today’s BFSI industry?

Currently, Data Analytics and AI are at a point of inflection, where luXury yesterday is turning into need tomorrow – as far as the significance of AI is concerned in the BFSI Industry. Data Analytics and AI Solutions aid financial institutions in making ‘smarter’ decisions – both financially and operationally. Also, Artificial Intelligence and Data Analytics have been invariably helping banks and financial institutions to reflect all required regulations and stay competitive while attending to the digital needs of today’s customers.

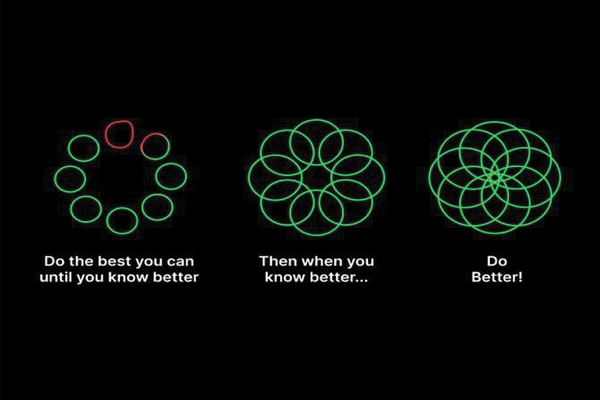

Big Data Analytics is expected to grow at a 30 per cent CAGR for the next 5 years. They are used in fraud detection & credit underwriting, in risk management, sales performance analysis, marketing, and personalised offers based on target segment, AI-driven chatbots as smoother customer service etc. Once ML-based algorithms are developed and nurtured with more focus, the time needed at an enterprise level to solve the same challenge is prone to reduce a lot.

What are the major challenges that will hinder implementing analytics in FIs? How to overcome them?

Data silos is the bigger issue. To look at collectively. Inaccessible and poor quality of data. Need a better data engineer to clean existing data. The collective look of data from multiple tangents unlocks better insights.

Also Read | “With technology, businesses regardless of their size have access to best financial products”

Availability of data engineering and data science resources. Demand is much more than the supply of candidates. SMEs (Subject Matter EXperts) are young and less experienced as this is an evolving subject. But, the plus point is there is much to learn from different industries’ experience in data analytics as this is not FI-specific.

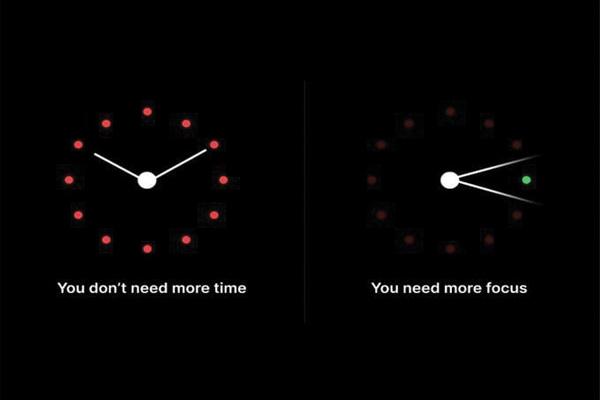

Pressure from the top & lack of clarity because of fear of uncertainty.

Budgets – As they are costly, but success rates also need to be less and grow with

time – as that is the nature of the product. Top Management has to actively involve and understand the behaviour of AI – so that they can support the decision.

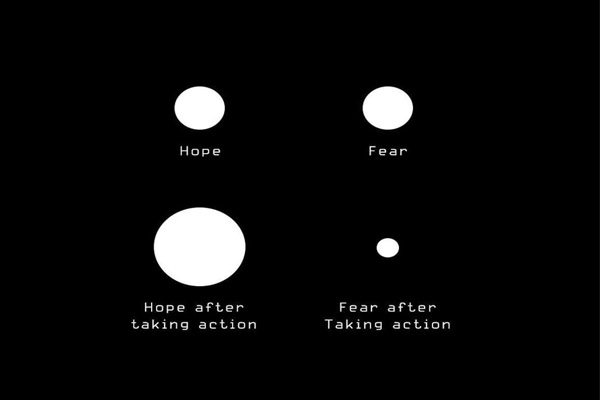

Prescriptive and/or outdated regulations constraining large-scale digital transformation initiatives – But this is observed to be changing these days. Fear caused by any factor when faced with hope caused by knowledge has to be put into action. Result changes and process ease post that.

In your view, is AI prudent enough to revolutionise lending space in India?

While it is definitely an influencing factor, revolutionising entirely or stand-alone is definitely a debatable topic. Lending defines a broad form of debt – including Gold loans

(physical yellow metal), Home/Property loans (lot of paperwork), Business loans (includes unstructured financials), personal loans, vehicle loans, e-commerce based loans etc.

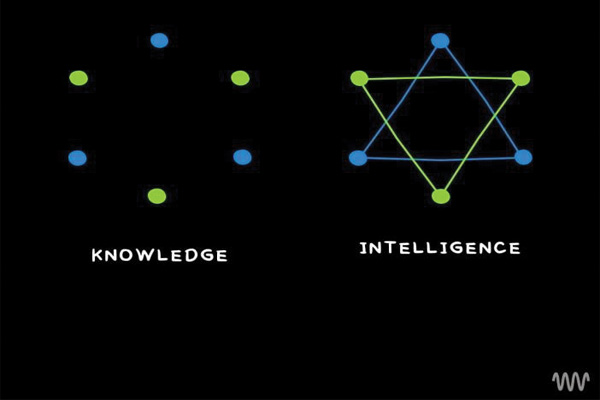

While AI definitely can revolutionise in personal loans and consumer finance, it can play a supporting role in other products – like computer vision via AI in gold loans, credit under writing ML modes in property loans etc. But on the other leg of collection allocation strategy and communication – a crucial role can be played agnostic of loan product. A special mention for risk management – which can start from fraud detection to superior deep learning models – is an influencing area. We all have knowledge of what to do. AI will help us how to do it and I would call it intelligence.

Do you think migration to next-gen analytics is the need of the hour? Will it help serve the cause of financial inclusion?

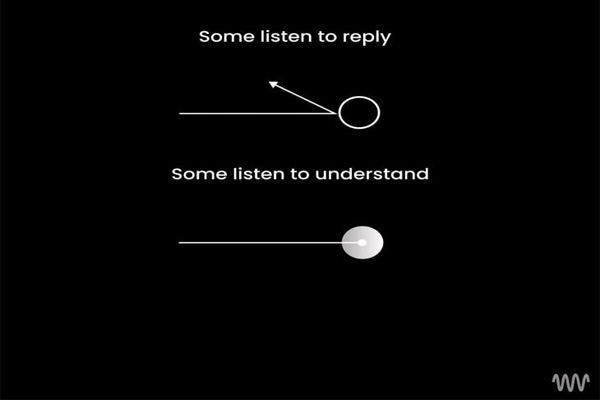

Next-gen analytics is moving from luXury to need and this transformation is happening at a rapid pace. It is essential to solve data silos ASAP with a proper data engineer. Behaviour wise, the next-gen audience has very less patience – but more understanding. They are returns and replacement guys – but not repair and recover people.

It is essential to understand the small hints they provide to retain them. Like a great person once said, stay close to customers and understand what he needs before even he can articulate. Solve it, the customer is always yours. It started with the expectation of, if gold coin can deliver at door step – why not the gold loan – and we saw the birth of door step gold loans. This is a much better way of speaking the e-commerce and social language which the next-gen understands to accelerate financial inclusion.

How do you see the future of BFSI in India with AI in the next three years?

Growth. Tremendous accelerated growth. Fundamentally, India is turning more from savings to expenses. Lot of money via start- ups/funding is being pumped to India. People are migrating from rural to urban. Mobile and payments have penetrated across India – including rural corners of the country. Global AI is expected to grow upwards of 32 per cent CAGR till 2030.

Also Read | Insurance in India can benefit from Technology/AI

Digital payments will account for ~72 per cent of total payments by 2025 – research says. Leveraging AI will make differentiated table stakes in India. Also AI becomes necessary as excessive digital transformation will call for cybercrimes and sophisticated frauds – which has to be kept in check with – AI from the lens of fraud & threat detection and credit underwriting which is evolving.

Images Courtesy: https://twitter.com/Wisdom_HQ/

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/