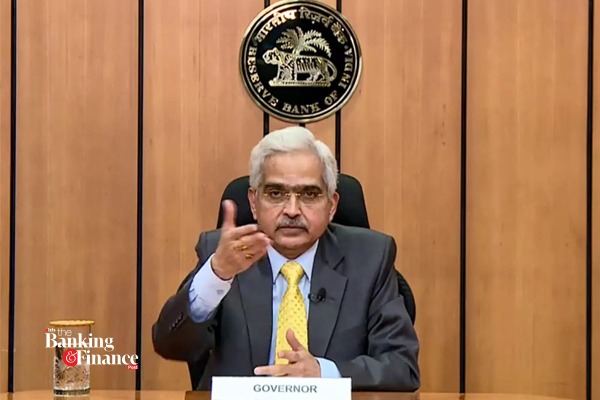

The Reserve Bank of India raised the repo rate, or prime lending rate, by 50 basis points to 5.90 percent, said RBI Governor Shaktikanta Das when announcing the Monetary Policy Committee’s recommendations (MPC). Since May, the central bank has raised the repo rate four times, to the current 5.90 percent. The recent repo rate adjustment was aimed to keep inflation levels within the target range.

By a vote of five out of six, the MPC voted to raise the repo rate. While announcing the repo rate hike, Das stated that the move was spurred not just by the need to limit inflation levels, but also by unfavourable action by global central banks, particularly those in advanced economies.

Das emphasised, “The globe has been rocked by two significant events: the COVID-19 epidemic and the Ukraine crisis. We are now in the middle of a third significant shock caused by monetary tightening and forceful messages from the central banks of wealthy countries.” He also announced the RBI’s exit from its accommodative posture, noting that the economy has remained robust despite high prices and fears of a worldwide recession.

With a rise in the repo rate, EMIs for house, vehicle, and personal loans are anticipated to rise as well. Home, automobile, and personal loans will become more costly as banks’ borrowing costs rise, causing lending rates to climb.

Shanti Lal Jain, MD & CEO, Indian Bank, said, “Increasing the policy rates by 50 bps has been in line with the market expectations. This calibrated action was needed to pull back headline inflation closer to the RBI tolerance band and keep inflation expectations anchored so as to ensure that growth is sustained. The RBI has continued with its pragmatic approach of supporting growth while keeping a check on inflation. This is evident by its decision to remain focused on withdrawal of accommodation. The increase in policy rate will also preserve the forex reserves and put a check on depreciation of rupee.”

A K Das, MD & CEO, Bank of India, stated that, “Broadly on expected lines, the Policy manifests RBI’s continued engagement with a prudent trade off between price stability and growth, with risks largely balanced”.

V P Nandakumar, MD and CEO, Manappuram Finance Ltd., said that, “Confronted with multiple challenges stemming from geo-political tensions, major central banks pivoting to more hawkish stance and spiralling inflation, the MPC has served the best policy prescription by raising the repo rate by 50bps to 5.9% while keeping systemic liquidity in surplus mode. This in my view will keep the Indian currency insulated from high volatility while keeping inflation expectations well anchored. Lowering GDP forecast to 7% mirrors a more realistic assessment of economic growth. On the whole, the MPC’s decision has been on expected lines in the given macro-economic scenario”.

Y. Viswanatha Gowd, MD & CEO of LIC Housing Finance, stated, “RBI’s hike in the repo rate by 50 bps is on expected lines and can be considered a well-measured decision. It is with the clear intention to safeguard the economy from any adverse implication out of the ongoing global financial turmoil. India’s economy continues to show resilience and looks promising despite the disruptions. The encouraging growth in the consumption pattern will continue to have a positive rub off on the home loan demand aided by festive sentiments.”

Dhiraj Relli, MD & CEO, HDFC Securities, said “The MPC voted to raise the repo rate by 50 bps taking it to 5.9% as widely expected while remaining focused on the withdrawal of accommodation. A higher rate hike is justified in the backdrop of inflation remaining at elevated levels with the projected trajectory being above RBI’s target during the entire forecast horizon. Economic growth has remained resilient in the face of an adverse global environment. The recent sharp depreciation in the rupee (although well managed compared to other emerging countries) might have weighed on members’ decision in favour of a larger rate hike, addressing external sector imbalance and reducing the interest rate differential. Unchanged inflation forecast at 6.7% for FY23 (and 5% in Q1FY24) is reassuring with a high average crude oil price of US$ 100 per barrel considered in this, providing a cushion. FY23 GDP projection was lowered marginally from 7.2% to 7% for FY23. Overall, it was a prudent policy announcement with no negative surprises which is reflected in the impact on the 10-year yield and stock markets. The next stage of response could be calibrated; we expect the terminal repo rate would be 6.25-6.40% by FY23 end.”

Poonam Tandon, CIO, IndiaFirst Life Insurance Company, stated, “The RBI raised key benchmark rates by 50bp and continued with withdrawal of accommodative stance. Given that the global environment remains challenging with financial conditions tightening and fears of recession mounting, the RBI stated that all segments of the financial markets are in turmoil globally and emerging market economies are also confronted with challenges of slowing growth, higher food and energy prices, spillovers from advanced economy policies, debt distress and sharp currency depreciation.

Also Read | Global Fintech Fest 2022: RBI Governor launches three key digital payment initiatives

Against this, the RBI has lowered the FY23 real GDP growth target to 7% versus 7.2% earlier even as domestic economic activity remains stable with resilient agriculture sector and strong credit demand. Moreover, despite the recent correction in commodity prices, CPI inflation target for FY23 has been kept unchanged at 6.7% on upside risks to food prices. The inflation forecast assumes Brent crude at $100/bbl in the 2HFY23. On the liquidity front, excess liquidity has moderated with LAF moving to deficit. The RBI has also decided to conduct only 14 day VRRR auctions from now on (merge 28 day VRRR with 14 day auctions). The RBI stated that intervention in FX market have been undertaken judiciously to curb volatility. Overall, the policy was largely in line and macro-economic stability remains the key focus area.

Raghvendra Nath, Managing Director – Ladderup Wealth Management Private Limited, said that, “the general consensus on the street was a 50-bps rate hike and RBI came through with it. The ripples from the global disruptions will act as headwinds to the economic growth in India which is indicative from the announcement of a contraction in the expected GDP number. Indian markets had already factored in the rate hike hence the markets have been resilient. Going forward, slowdown in global markets and high inflation would be key determinants of further rate hikes in India.”

Madhavi Arora, Lead Economist, Emkay Global Financial Services, said “The MPC delivered a 50bps hike in line with expectations. Clearly, the fast-evolving world order and consistent repricing of Fed’s outsized hikes are strong-arming the EMs. This painful adjustment has not spared the RBI either, which realised the net cost of a supposed soft signalling via shallow hike could be higher than a larger hike of 50bps. This exposes the instability inherent with the classic EM central bank trilemma: one cannot have a stable currency, unfettered capital flows, and independent monetary policy all at the same time.”

“This conscious front-loading could give them some breather next year on shallow hikes ahead. With inflation likely to be largely in line with RBI’s estimates, this week’s 50bps hike will make the ex-post forward real repo rate positive, albeit still lower than the RBI’s estimated real neutral rate of 0.8-1 per cent. At this point, we still think that the RBI would not go too restrictive, and the terminal rate could hover near the estimated real rates, implying not more than 100bps hikes ahead, including today’s decision. However, the extent of global disruption will remain key to the RBI’s reaction function ahead.”

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/