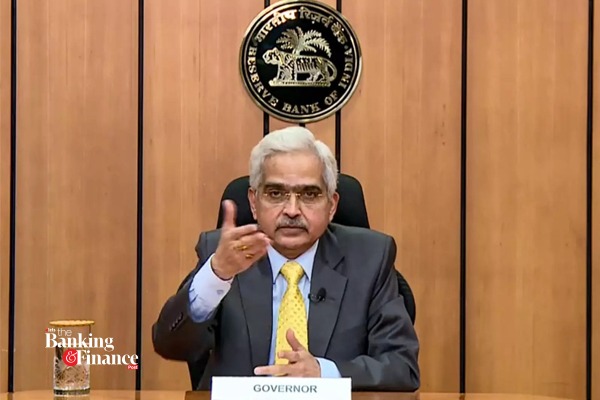

Digital lending firms should operate under the licenses given to them, said Shaktikanta Das, Governor of the Reserve Bank of India. He also said that the central bank could not allow the building up of risk on the economy due to unlicensed operations of fintech firms.

He stated that “Our responsibility is to maintain financial stability, the firms should operate under the licenses granted to them. If they are doing anything beyond that then they should seek our permission. Without permission, if they are engaging in activities for which they have no license then it is not acceptable. There will be risk build and we cannot allow that.”

Due to fintech firms, the central bank has highlighted the risk posed to the financial system. In the recently released Financial Stability Report, the RBI had called for the need to shield the financial system from the fintech industry’s potential.

Industry experts have said RBI’s new rule would affect at least about 8 million BNPL customers after firms either stopped their offerings or slowed down fetching new clients. Fintech firms had launched products around credit that were driven by non-banking financial companies (NBFCs) and delivered through PPIs.

Also Read | RBI’s FSR projects green shoots on the domestic banking front in a difficult global macro environment

Meanwhile, the governor also said that the regulator will issue a consultation paper on climate change and risks related to the bank and financial institutions.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/