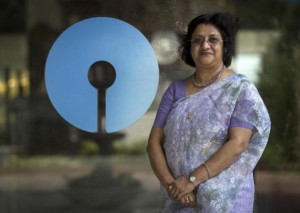

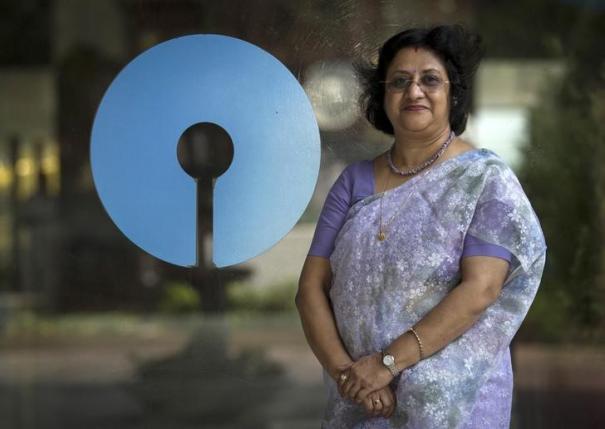

Public sector giant State Bank of India (SBI) which created history by merging six of its associates at one go, has now pledged to ensure better customer services post the merger, said Arundhati Bhattacharya, Chairman, SBI.

“Mergers should be such that it should benefit the customers and should also result in adding value to shareholders,” said Bhattacharya, in alignment with Union Finance Minister Arun Jaitley and Reserve Bank of India Governor Urjit Patel’s campaign for consolidation of state-run banks.

“Mergers should reduce dependent of capital resources from the government,” She added.

The apex banking regulator RBI and the Central Government acquire the three-fourths share in the Indian banking system and they are rigorously working on merging some of the 22 state-run banks.

There are several challenging issues that are coming their way, such as similar product offerings, and often have geographical overlap.

In addition to this, majority of the banks are struggling to overcome bad loans, straining the government’s resources.

“Need to meet the capital adequacy ratio of banks are ill advised. There are three purposes that a merger should serve — efficiency, market power and better accounting ratios,” she said.

Bhattacharya added that size should not be a criterion for mergers. “Size may not guarantee survival,” she said.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/