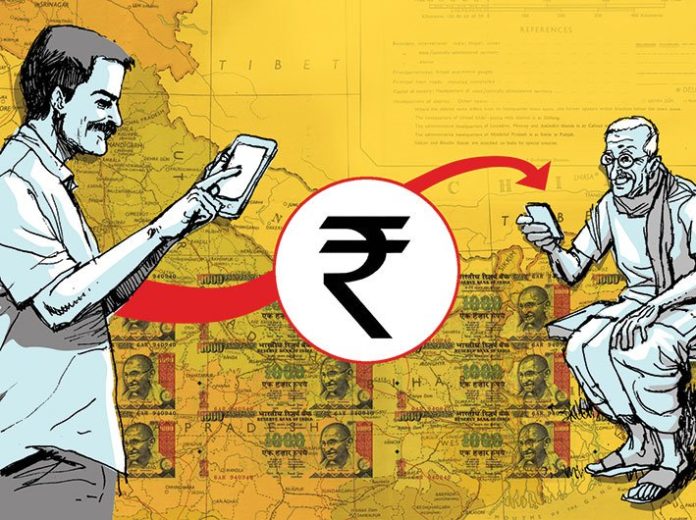

The Indian banking sector has undergone a digital makeover post-demonetisation. In this era, the payment methods are one of the few happening spaces and therefore various modes of digital payments are making their way to the cashless economy. One such mode gaining momentum lately is the Payments Bank, explores Rashi Aditi Ghosh of Elets News Network (ENN).

The Indian banking sector has undergone a digital makeover post-demonetisation. In this era, the payment methods are one of the few happening spaces and therefore various modes of digital payments are making their way to the cashless economy. One such mode gaining momentum lately is the Payments Bank, explores Rashi Aditi Ghosh of Elets News Network (ENN).

Understanding Payments Bank

Payments Banks, the new simplified way of banking, are expected to reach the customers mainly via mobile phones.

A payments bank is like any other bank, operating on a smaller scale without involving any credit risk. It can carry out most banking operations except advancing loans or issuing credit cards. It has the limit of accepting demand deposits up to Rs 1 lakh, offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third party fund transfers.

Birth of Payments Bank System in India

In September 2013, the Reserve Bank of India (RBI) constituted a committee headed by Dr. Nachiket Mor to study comprehensive financial services for small businesses and low income households. It was meant to propose measures for achieving financial inclusion and increased access to financial services.

The committee submitted its report to the RBI in January 2014. One of the key suggestions of the committee was to introduce specialised banks or ‘payments bank’ to cater to the lower income groups and small businesses so that by January 1, 2016 each Indian resident can have a global bank account.

Significance of Payments Bank

The idea behind Payments Bank was to provide financial services to the remotest corners of the country. It was something that the traditional banking model could not achieve to the optimal level.

Today, the main objective of payments bank is to widen the spread of payment and financial services to small business, low-income households, and migrant labour workforce in secured technology-driven environment.

Payments banks hold the potential to add wings to the government’s ambitious financial inclusion targets. The RBI has given 11 entities approval in principle to open these banks.

Recently, the India Post became the third entity to receive the final nod from RBI to start its payment bank operations.

Prior to this, telecom service provider Bharti Airtel and digital payments brand Paytm had received the license for Payments Bank. Airtel has already rolled out its operations.

The country’s apex bank awarded license to the India Post Payments Bank (IPPB) last month and the latter’s operations are anticipated to commence before March 31 this year. The IPPB is expected to roll out in 650 districts with the help of its mammoth network of 1.54 lakh post offices in the country, a leading English daily recently reported.

RBI Guidelines for Payments Bank

It is pertinent to mention that the payments banks are given the status of scheduled banks under Section 42 (6) (a) of the RBI Act, 1934. The words “Payments Bank”, however, have to be used by the companies in their name to distinguish it from other banks.

The payments banks, which are licensed under section 22 of the Banking Regulation Act 1949, have to mainly accept the demand deposits and provision of payments and remittance services. A number of bodies, which will govern the payments include the Banking Regulation Act, 1949; Reserve Bank of India Act, 1934; Payment and Settlement Systems Act, 2007; Deposit Insurance and Credit Guarantee Corporation Act, 1961; Foreign Exchange Management Act, 1999; and other relevant directives and statutes, according to a business daily.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/