India’s largest private sector bank ICICI Bank has unveiled a new NFC-based mobile payment app that allows customers to make payments by simply tapping their mobile phones on a merchant terminal.

India’s largest private sector bank ICICI Bank has unveiled a new NFC-based mobile payment app that allows customers to make payments by simply tapping their mobile phones on a merchant terminal.

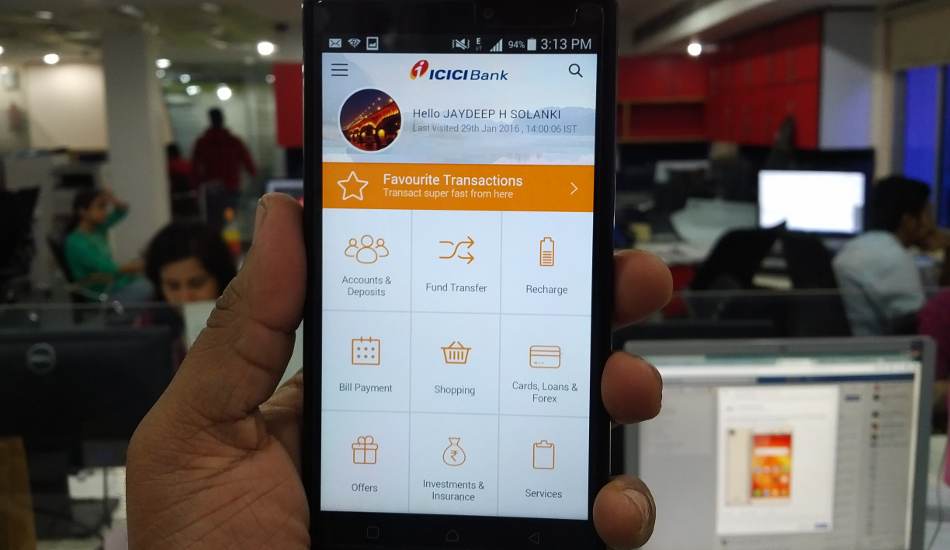

The iTap app is a complete contactless payment system that enables the user to wave his/her NFC-enabled mobile phone running Android 4.4 and above for making the payment at any merchant terminal supporting NFC.

“iTap is the first contactless mobile payment solution that that will allow cashless payments using just smartphones to eradicate the practice of carrying cash, debit and credit cards. I am definitely optimistic that it will transform the smartphone into a virtual wallet as India is second largest market globally for mobile subscribers. Isn’t it exciting that people need not to carry wallet or credit cards each time they go for shopping? It’s fast, simple and reliable. It will immensely help people at quick service restaurants and shopping marts where rapid transactions are required,” said Rajiv Sabharwal, Executive Director at ICICI Bank.

With the launch of this app, ICICI Bank has emerged as India’s first financial institution to employ Host Card Emulation (HCE) technology. The technology creates virtual cards for physical debit and credit cards (Visa/MasterCard) which can then be used for making payments.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/