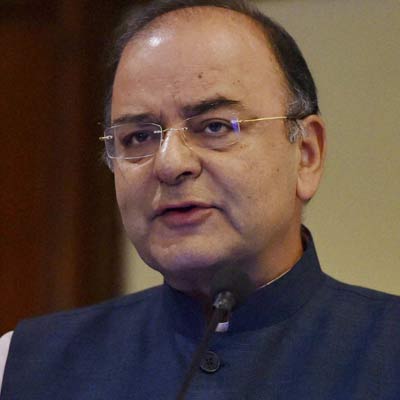

Union Finance Minister Arun Jaitley said that Non-Performing Assets (NPAs) in Public Sector Banks (PSBs) have reported a decline and the economy is now leading towards good growth.

Union Finance Minister Arun Jaitley said that Non-Performing Assets (NPAs) in Public Sector Banks (PSBs) have reported a decline and the economy is now leading towards good growth.

“Banks are very confident that under the circumstances they will maintain liquidity for the various sections of the economy, the liquidity which is required,” said Jaitley after reviewing the annual performance of public sector banks.

The minister also unveiled a website of public lenders named psbloansin59minutes.com, where Micro, Small & Medium Enterprises (MSMEs) can get loan of up to Rs 1 crore in less than an hour.

He said that banking activity in the country is bound to gain momentum as the consumption has moved up. During the meet he also launched the Financial Inclusion Index.

Lenders expect cash recoveries of Rs 1.80 lakh crore in 2018-19 and PSBs will also be able to monetise non-core assets worth Rs 18,665 crore, said financial services secretary Rajiv Kumar in a presentation during the annual meet.

“There is equal focus on arresting fresh slippages,” he added.

Jaitley asked the lenders to ensure all necessary measures from their end to maintain clean lending and effective action to control fraud and willful default for justifying the trust reposed in banks, the finance ministry said in a statement.

He further said that initiatives such as Insolvency and Bankruptcy Code (IBC), Goods and Services Tax (GST), demonetisation and digital payments have helped in ensuring better assessment of financial capacity and risks.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/