At a time when Government is reinforcing its efforts to bring millions unbanked into banking folds, NPCI, backed by Reserve Bank of India, has unveiled Unified Payments Interface (UPI) to facilitate payments as simple as sending SMSes. Even Prime Minister Narendra Modi recently advocated the need of adoption of digital transactions. Vishwas Dass of Elets News Network (ENN) gives an insight on UPI’s functionality, significance and the mission of migrating from a cash-based economy to a cash-less society

At a time when Government is reinforcing its efforts to bring millions unbanked into banking folds, NPCI, backed by Reserve Bank of India, has unveiled Unified Payments Interface (UPI) to facilitate payments as simple as sending SMSes. Even Prime Minister Narendra Modi recently advocated the need of adoption of digital transactions. Vishwas Dass of Elets News Network (ENN) gives an insight on UPI’s functionality, significance and the mission of migrating from a cash-based economy to a cash-less society

Ever since the incumbent Government came to power in 2014, it has been laying a lot of emphasis on bringing banking and financial services to millions of citizens-particularly the disadvantaged and those living in the remote parts.

Irrespective of the fact that the Government has intensified efforts of strengthening financial inclusion, a huge chunk of population is yet to have bank accounts. Enabling 1.2 billion people, many of whom have never seen a bank or opened an account, to send digital payments to each other is an herculean task in front of the Government.

In this context, National Payments Corporation of India (NPCI) – the umbrella organisation for all retail payments in the country, backed by Reserve Bank of India (RBI), launched Unified Payments Interface (UPI) on April 11 with an objective to change the way digital payments are made in India. With UPI, NPCI is endeavouring to migrate to a less-cash and more digital society.

UPI’S CORE FEATURES

|

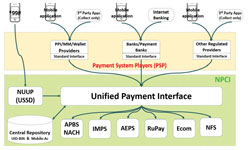

UPI is a system designed to make transferring and receiving money as easy as sending text messages. At present, banks are testing pilot apps with UPI system, which are expected to be unveiled in a few months. You’ll be asked to sign up for UPI once the bank app is updated with the feature. It will run on Immediate Payment System (IMPS) platform. IMPS allows one to send money from one account to another in real-time basis but a transaction can be made only if both the sending and receiving banks have enabled the IMPS.

While IMPS needs receiver’s bank account details, the UPI system will just need a virtual ID, similar to an email address for authentication. UPI already has 29 banks on its network. Though the transaction limit for IMPS is Rs. 2 lakh per transaction, for UPI the limit has been set at Rs. 1 lakh.

According to UPI’s mechanism, one will get an ID from the bank that serves as the username for transactions. In order to make payments like for shopping or paying utility bills, besides the usual netbanking, credit and debit card options, there will also be a UPI option. On  choosing the UPI, one will be asked for his/her username – email-like ID – provided by your bank. Once it is provided, one needs to enter a MPIN which is like an ATM pin and that is set up on the first UPIN transaction.

choosing the UPI, one will be asked for his/her username – email-like ID – provided by your bank. Once it is provided, one needs to enter a MPIN which is like an ATM pin and that is set up on the first UPIN transaction.

During an interaction with The Banking and Finance Post Magazine, Managing Director and CEO of NPCI, Abhaya Prasad Hota admitted that IMPS already entails a facility for immediate transfer of funds but lacks immediate receipt or collect which NPCI always wanted to incorporate.

“IMPS requires IFSC code and account number at the time of sending the money. We thought of creating an ecosystem where we can avoid such large data entry and IFSC code and account numbers are masked in such a way that a new financial address is built up. UPI was the answer to this problem which offers a facility to identify a bank customer with an email-like virtual address. It allows a customer to have multiple virtual addresses for multiple accounts in various banks. There was an urgent need for improvising the success ratio in the eCommerce transaction. In card payment system when the eCommerce transaction happens and people pay by cards, the success ratio is hardly 65 to 70 per cent. We thought that how can we make use of IMPS for eCommerce transaction. So if there is a button for eCommerce collect which is UPI or IMPS Plus then money can be collected easily. User experience also needs to be made more friendly.”

| OBJECTIVES OF UPI To offer an architecture and a set of standard Application Programme Interfaces (APIs) to facilitate the next generation online immediate payments leveraging trends such as surge in smartphone use, Indian language interfaces, and universal access to Internet and data |

Hota further said that to ensure privacy of customer’s data, there is no account number mapper anywhere other than the customer’s own bank. This allows the customer to freely share the financial address with others. A customer can also decide to use the mobile number as the name instead of the short name for the virtual address like 1234567890@sbi.

Nandan Nilekani, Advisor to NPCI Nandan Nilekani, Advisor to NPCIThis is a leapfrog. It is been made possible because NPCI had built Immediate Payment Service (IMPS) platform and this is a layer we have put on IMPS |

Nineteen banks like Axis, ICICI, and HDFC have already come on board with the UPI and many more are expected to join the system by end of this year, remarked Hota.

In order to go deep into what made the NPCI to introduce the UPI, we need to understand the RBI Payment System Vision Document (2012-2015) as well. It underlines a few challenges like number of non-cash transactions per person stands at just 6 per year, a fraction of the 10 million plus retailers in India have card payment acceptance infrastructure – presently this number stands at just 0.6 million and less than one lakh out of six lakh villages have banking services at the end of March 2011 and around 145 million households are excluded from banking. The document attributed Direct Benefits Transfer (DBT) and Jan Dhan Yojana (PMJDY) behind significant growth in the number of households having bank accounts.

| The RBI Payment System Vision Document (2012-2015) emphasises the mission and vision clearly. Mission Statement- To ensure payment and settlement systems in the country are safe, efficient, interoperable, authorised, accessible, inclusive and compliant with international standards. Vision- To proactively encourage electronic payment systems for ushering in a less-cash society |

NPCI has also found increasing usage of mobile phones as a main reason behind unveiling UPI. One of the most transformational technologies that has changed India is the massive adoption of mobile phones. From nearly no phone access, Indians went straight into using mobile phones in a massive way. A combination of regulatory and open market approach led to massive competition among a plethora of companies to compete and provide best value to end-customers. Low cost phones, affordable tariffs, and a massive distribution network to handle pre-paid plans and recharges allowed an explosion of user base to a billion people.

Desktops never managed to penetrate into daily lives of masses due to their price, complexity, interaction model, and its inability to be mobile. Whereas smart phones, with its affordable prices, simplicity, easier touch-based interaction, and mobility has caught the imagination of masses. Smartphone adoption in India is exploding at a rapid pace and is expected to become the de-facto computing device for millions of people.

In the 20th edition of ‘Mann Ki Baat’, Prime Minister Narendra Modi on May 22 laid emphasis on the need of migrating from cash-driven economy to a cashless economy. He said that globally, more technology is being used and people prefer digital transactions today.

“There was a time when barter system prevailed much before the commencement of coins and currency notes. Then followed the coins and currency, but now the world is heading towards cashless transactions,” Modi told in his public broadcast.

e-Wallets see UPI as a big challenger

With the launch of UPI, some fear that mobile wallets may become obsolete. What worries the e-wallets is the fact that only banks are allowed to be a part of UPI that has been launched by the NPCI while the wallet players have been left out of its ambit.

Experts opine that using UPI could also make it easier to directly transact with a seller for a buyer. Wallet payment services enable people to make payments only to those who have also subscribed to the same service. As an instance, a consumer can pay for, say, a taxi ride using his e-wallet only if the driver is also using the system, but UPI does not require that and one can send money to any account.

Experts opine that using UPI could also make it easier to directly transact with a seller for a buyer. Wallet payment services enable people to make payments only to those who have also subscribed to the same service. As an instance, a consumer can pay for, say, a taxi ride using his e-wallet only if the driver is also using the system, but UPI does not require that and one can send money to any account.

| “The developments in mobile telephony, as also the mobile phone density in the country, with over 870 million subscribers, presents a unique opportunity to leverage the mobile platform to meet the objectives and challenges of financial inclusion. By harnessing the potential of mobile technology, large sections of the un-banked and under-banked society can be empowered to become inclusive through the use of electronic banking services.”- Report of the Technical Committee on Mobile Banking, RBI, Feb 2014 |

It has emerged as a real big threat to wallet players who have wooed a large chunk of tech-savvy urban customers. If experts are to be believed, in order to survive and remain in the industry, wallet players will now need to tweak their business model to generate additional sources of revenue.

It is evident that UPI can reach far more people than all e-wallets put together today, given that its platform is open to users from all banks.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/