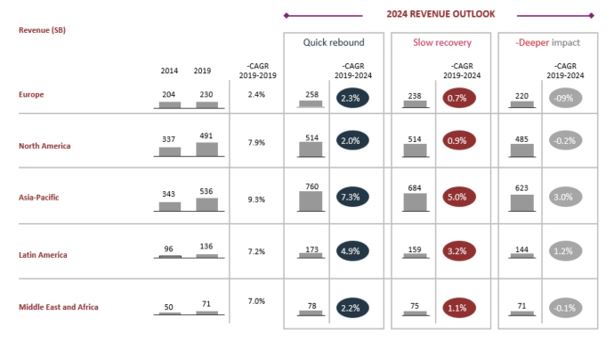

BCG forecasts payment revenues globally could grow to US$1.8 trillion by 2024, from US$1.5 trillion in 2019, lifted by the continued transition away from cash, sustained strong growth in electronic transactions, and greater innovation. Likewise, McKinsey in its Bank Pulse study 2021 predicts payments revenues would grow to US$1.6 trillion by 2025

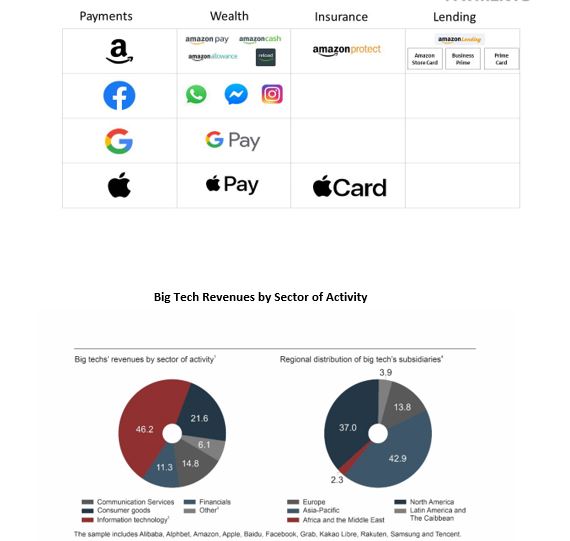

Yet, incumbent institutions would need to work hard to capture this growth. The space is increasingly crowded, with an expanding array of non-traditional players. Open-banking legislation enacted across countries has removed of the largest barriers to entry for external players, levelling the playing field. In addition to Fintech players, Techfins, Amazon, Google, Facebook, Apple, Tencent are rapidly diversifying into financial services as part of a larger ecosystem dominance strategy.

Most Big Techs are leveraging their existing consumer base and behavioural data collected over the years to develop better payments solutions. These players embed payments and financial services into their core products to make them more attractive. The platform-centric data-driven business models of Techfins distinguish them from other businesses. Also, as they have the requisite financial muscle, and the Techfin business model is independent of margins generated from financial services, they pose a bigger threat to banks than Fintechs, As they make in-roads into the payments space, according to Accenture, the players would shrink the payments revenue pool for banks by 15 per cent by 2025 and may cost up to US$280 billion in revenue opportunity loss globally.

DNA of Techfin Players

Increasingly,,Techfins are looking beyond payments to capture traditionally profitable product pools. Compared to Fintechs, these players are well-placed to challenge legacy banks, as they have all the advantages of a mainstream bank — a wealth of data and a large, sticky, existing customer base. Google for instance has become the first regular TechFin to open a checking account, starting with Citibank and 10 other banks and credit unions in the US.

Techfin-led peer-to-peer and marketplace lending models have also recorded sharp growth in many economies. Amazon, for instance, uses data to underwrite small loans for merchants, consumers and SMBs. Likewise, Alibaba-owned Mybank disburses instant credit to MSMEs within 3 minutes. BIS estimates that the flow of these new forms of credit reached US$223 billion and US$572 billion in 2019, respectively.

Areas of Operation TechFin

Techfins are aiming for the distribution side of the business and are happy to collaborate with banks to take care of regulation, compliance. They have no legacy infrastructure (e.g., branches) so their costs are lower, and the provision of financial services will keep customers within low-cost ecosystems.

As Techfins further establish their presence, they will develop new revenue models for the industry. These are expected to replace fee-based models as primary sources of revenue. Most Techfins are leveraging their existing consumer base and behavioural data collected over the years to develop better payments solutions. Once they firmly establish themselves in the payment’s ecosystem, they look to add other complementary products/services that can be cross sold to increase customer stickiness and generate incremental revenue.

Implications for Incumbent Institutions

1.1. Reorient Business Models

The redistribution of profit pools will force incumbents to reorient business models, pick up the pace of digitization, gain economies of scale, and manage risk in new ways — whilst ramping up innovation. Although there is no standard playbook, three primary strategic options would emerge

Value shifts from payment plumbing to control over digital channels. Banks cede control over distribution to Techfins and provide mere payments plumbing. Due to cost commoditization, incumbents will consequently see a decline in profit margins.

Incumbents embrace ecosystem play, curating services, particularly in markets, where open banking regulations have been enacted. Platforms that offer the ability to engage with financial products from a single location will become the dominant model for the delivery of financial services Banks would choose between being a multi-service integrated provider of both financial and non-financial services, or they could become a specialized niche organization for a specific segment of the banking community

Incumbents offer Banking-As-a-Service and expose APIs to third party partners as well as participate in external ecosystems to expand distribution and improve access to new customers.

1.2. Build an Agile Technology Foundation

Many incumbents are mired under the weight of inflexible legacy systems. According to a 2019 study by consultancy Cornerstone, almost 70% of respondents said that their institution’s current technology infrastructure was a barrier to digital transformation and a staggering 55% of banks stated they lacked digital maturity, with only 12% rating themselves as digital leaders earlier in 2020. Banks need to invest in an agile technology foundation to innovate and integrate with ecosystem partners at market speed. This will require an end-to-end digital banking transformation, driven using data, AI, applied analytics and cloud computing.

1.3. Adopt Data-Driven Approach

Data will become increasingly important for differentiation, but banks data sets will be enriched by flows of data from multiple sources. Techfins enjoy the advantage of having a single view of customers across verticals in which they operate, which provides an irreplaceable competitive edge.

A large number of incumbent banks would need to transition rapidly to stay competitive. They lack inhouse capabilities and need to collaborate with payment technology vendors, who can play the role of technology and market specialists to help incumbent institutions navigate the new landscape.

Views expressed in this article are the personal opinion of N.Satish, Deputy Chief Product Officer, FSS.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/