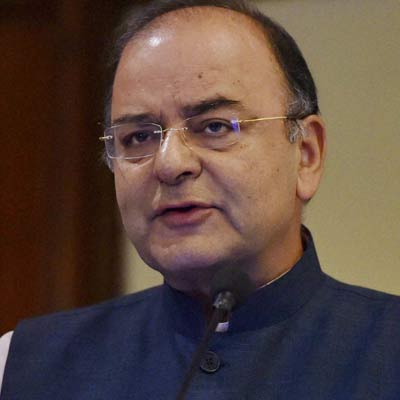

Finance Minister Arun Jaitley has announced the revised interest rates on small saving investments which will result in lower returns. The earning of Public Provident Fund, which is currently 8.7 per cent, will now decrease to 8.1 percent. The revised interest rates, which will be effective from April 1, 2016 for the first quarter of 2016-17, are 60-130 points lower, as per the scheme.

The current interest rate of 8.7 percent on Kisan Vikas Patra has been reduced to 7.8 per cent and the National Saving Certificate interest rate has been reduced from 8.5 to 8.1 per cent. Also, the rate on Monthly Income Scheme has been slashed to 7.8 per cent from 8.4 percent.

The rate cuts, which will prove to be beneficial for the banks due to lower interest rates, will hit the pocket of common man, especially retired people.

The Finance Ministry has also revised the interest rates on Sukanya Samriddhi Account and the Senior Citizens Saving Scheme by reducing them from 9.2 per cent and 9.3 per cent respectively to 8.6 per cent. Hence, the ministry overlooked its earlier indication of not touching these two rates as they serve “laudable social development or social security goals.”

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/