Quantum Computing (QC) is fast emerging as a disruptor in the Next Generation Computing (NGC) with immense potential and multitude of use cases across various industries. Like the well-established Software-as-a-Service (SaaS) model that provides access to software services on the cloud, Quantum Computing-as-a-Service (QCaaS) provides on-demand services of quantum computing via cloud. As quantum mechanics forms the basis of Quantum Computing (QC) with important features such as superposition and entanglement, QC enables faster processing of much larger and complex problems that may pose a challenge to traditional supercomputing. The QC on the cloud can be connected to the distributed computing infrastructure in an organization to provide Next Generation Computing (NGC) in a “distributed quantum framework”. QCaaS provides versatility through a single application to different business units in an organization for faster processing and quicker decision-making.

With inherent enhanced security measures and cryptographic techniques in QC, QCaaS can seamlessly interface with the Blockchain interface in an organization. As multiple organizations and startups started offering QCaaS in the recent past, new avenues are being opened in drug discovery, financial portfolio optimization, financial market crash predictions, forecasting, securities trading, etc. A quantum computer from Oxford Quantum Circuits located in an Equinix IBX data centre in Tokyo, Japan is shown in Figure 1 (Ref [1]). In the latest development, on 4th December 2023, IBM announced the release of the first ever 1121 superconducting qubit quantum processor based on cross-resonance gate technology (Ref [2], [3]).

Figure 1. A Quantum Computer from Oxford Quantum Circuits (Ref [1])

Keywords: Quantum Computing, Software-as-a-Service (SaaS), Quantum gate, Quantum annealing, Cloud Computing, Quantum Service Computing, Hybrid classical-quantum software architecture

II. Quantum Computing as a Service (QCaaS)

The early origins and details of Quantum Computing system including Hardware layer (superposition, entanglement, analogue quantum computing, quantum annealing, and digital gate-based quantum computing), system software layer, and application layer (Grover’s algorithm, Shor’s algorithm, Harrow Hassidim Lloyd (HHL) algorithm) are presented in Ref [4]. As the capital investments in quantum computers are still very high with additional difficulty in operating them at specific temperatures under stringent environment, several major computing corporations such as IBM (IBM Quantum Computing), Google (Google Quantum AI), and Amazon (Bracket) started to build their own quantum computers with the idea of offering them to end users on a pay-per-use model as part of Quantum Computing as a Service (QCaaS) strategy to generate revenue streams from pay-per-shot Quantum Computing, defined as a single execution of a quantum algorithm on a quantum processing unit (QPU). QCaaS enables developers to write specific modules of source code and execute tasks such as prime factorization, key encryption, or simulations on quantum computers.

Figure 2. Generic view of Quantum Computing as a Service (QCaaS) (Ref [5])

A generic view of a Quantum Computing as a Service (QCaaS) is presented in Figure 2 (Ref [5]. An overview of the Quantum Computing System (QCS) comprising Quantum Hardware (Processor and Storage), Quantum Software (Quantum Gates, Quantum Bits), and Quantum Information Processing (QIP) is presented in Figure 2 a). Quantum software systems include quantum source code compilers that allow quantum algorithm designers and programmers to write, build, and execute software for quantum computers that execute tasks as part of QIP. The Quantum Service Computing model consisting of Quantum Service Orientation is shown in Figure 2 b) where a QC user (e.g., service requester) can utilise the QC resources offered by quantum vendors (i.e., service provider).

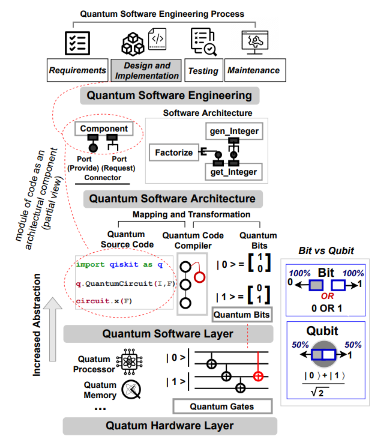

Read more: Impact of Surge in Electric Vehicles on Insurance in the Mobility Industry

The details of a typical hardware and a software layered architecture are shown in Figure 3 (Ref [6]). As Figure 3 indicates, there is an increased abstraction as we go from the bottom Hardware Layer towards the top Quantum Software Architecture (QSA) and Quantum Software Engineering (QSE) with the Quantum Software Layer (QSL) controlling the hardware layer. The Quantum compilers act as a conduit between the Qugates (hardware) and Qubits (software) and help compile and execute the quantum source code. As can be seen in Figure 3, as we go from QSA towards QSE, the module of code is generated using the hardware layer and a quantum programming framework such as OpenQL with the associated quantum programming languages such as Q# and QCL and compilers to convert the code into executable instructions while abstracting out the hardware aspects. The architecture presented in Figure 3 facilitates error-free and bug-free quantum software through the

Figure 3. HW & SW Architecture Layers for a typical Quantum Computing System (Ref [6])

design and development of QCS components and systems through HW/QSL/QSA/QSE and the associated processes.

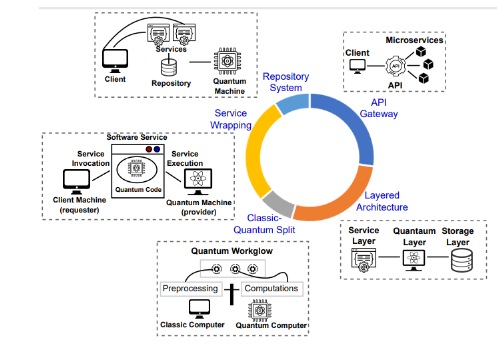

Figure 4. Quantum Computing Service Pattern (Ref [5])

A typical Quantum Computing Service Pattern is shown in Figure 4 (Ref [5]) comprising a) Classic-Quantum Computing Split, b) Quantum Service Layered Architecture, c) Service Wrapping, d) API Gateways, and e) Repository System. The purpose of the Classic-Quantum Computing Split is to enable a hybrid classical-quantum computing environment and split computation tasks into those that can be executed on classical computers (e.g., random number generation) and those that can be executed on quantum computers (e.g., prime factorization). The API gateway includes multiple microservices serving a client while the Repository System includes mining repositories and knowledge sources from past project executions, best practices, and lessons learned.

III. Quantum Computing for Finance

The finance industry has been at the forefront of technology adoption of quantum computing as multiple use cases have been formulated for solving by quantum computers that are traditionally found to be difficult or slow on classical computers even though the current quantum computers are still evolving, noisy, and have higher quantum error rates.

Quantum Machine Learning (QML) algorithms developed specifically for Quantum Computing Systems (QCS) have been evolving and becoming more efficient to accommodate flexibility to handle different data types and scalability to handle larger data sets. Different aspects of QML are utilized on both structure and unstructured datasets in different financial applications such as a) regression for asset pricing, b) classification for portfolio optimization, c) clustering for portfolio risk analysis and stock selection, d) generative modelling for market regime identification, e) feature extraction for fraud detection, reinforcement learning (RL) for algorithmic trading, g) Natural Language Processing (NLP) for risk assessment, financial forecasting, accounting, and auditing, and h) Deep Learning for image recognition (Quantum Cheques) (Ref[6]). Some of the financial applications are described in the subsequent paragraphs.

A. Regression

The key aspect of supervised learning is Regression, which involves training a simple model to approximate real-valued functions. When applied on big data in financial analysis, this can be formulated as minimizing a loss function that captures the quality of the fit on training data.

QML-based Asset Pricing

Asset Pricing is the task of assigning prices to various categories of financial instruments, such as stocks, bonds, and derivatives to understand the behaviour of risk premiums and is based on economic models such as equilibrium pricing and arbitrage-free pricing. Predicting spot prices can be modelled as a time series learning problem. Asset Pricing is essentially about predicting the spot prices in the future based on historical financial data and utilizing stochastic processes such as Brownian motion to train the data and develop a model based on supervised regression ML. Researchers have been increasingly turning to the usage of RNN-based deep learning algorithms utilizing LSTM techniques for time-series predictions for Asset Pricing.

B. Natural Language Processing

Natural Language Processing (NLP) deals with automated text and language analysis. A shortcoming of most search engines using classical NLP is that they understand the meaning of separate words and not the grammatical structure of the sentence. Recent research in NLP has resulted in distributional compositional semantics (DisCo), wherein the proximity of two words in a sentence is measured by the similarity between them, calculated using the inner product of their normalized representative vectors, and thus computing the meaning of individual words (Ref [7, 8]). DisCo models and algorithms derive the meaning of a sentence from known meanings of component words. With the recent developments in Post Quantum Cryptography (QPC), wherein classical data is encoded on quantum hardware, quantum NLP is found to be particularly suitable for NISQ devices. The quantum DisCo models can encode linguistic structures much faster, resulting in a few potential applications of the quantum NLP techniques in the financial sector that are discussed below.

Risk Assessment

Credit risk assessment is an important metric for banks to quantitatively assess the chances of a successful loan payment (Ref [7, 8]). When past loan payment history or spending patterns are not available, NLP techniques could be deployed to assess incoherent data and arrive at creditworthiness. Additionally, NLP techniques are used to assess credit risk by measuring the entrepreneurial mindset in a business loan or a borrower’s emotions during a personal loan.

C. Reinforcement Learning

Reinforcement learning (RL) utilizes learning through interactions with the environment as part of ML algorithm development. Recently, researchers derived a quantum RL algorithm with quadratic performance improvements on an optimization function in multiple parameters that is found to be superior to the corresponding classical algorithms (Ref [7, 8]).

Algorithmic Trading

Algorithmic Trading involves systematic execution of trading in financial instruments by evaluating the market variations with little or no human inputs or intervention. RL formulates algorithmic trading as a sequential decision-making problem wherein trading decisions are obtained directly that maximize the cumulative returns over a specified time period. Using quantum ML techniques, algorithmic trading can be extended to include multi-period portfolio selection with boundary conditions of rebalancing the portions of capital invested in selected assets at each stage (Ref [7, 8]).

D. Generative Modelling

Generative Modelling is based upon probability distribution over a given data set and is applicable to both supervised and unsupervised learning. As measuring a quantum state naturally results in a probability distribution over the output, quantum computation appears to be a natural choice for generative modelling.

QML-based Anomaly/Fraud Detection

In financial applications, anomaly/fraud detection plays a critical role in identifying potential credit card fraudulent transactions, money laundering, spurious access to communication networks and cyberactivity, and other suspicious activities. While in classical computing, statistical analysis and ML techniques based on unsupervised deep learning are used to detect anomalies, quantum generative adversarial networks (qGANs) or parametrized quantum circuits to model the generator are used in quantum computing for anomaly/fraud detection (Ref [7, 8]). Additional anomaly detection techniques include a) quantum amplitude estimation, b) k-means clustering methods, c) quantum Boltzmann machines, and d) kernel-based clustering methods.

Conclusion

Quantum Computing, through Quantum Computing as a Service (QCaaS), has been evolving into a technology disruptor to offer superior quantum computational services over classical computing across different industries and applications. As the finance industry has traditionally been an early adopter of advanced technologies, QCaaS has been making inroads along with AI/ML algorithms and Generative AI to offer solutions to problems involving high computational complexity. Though QC is still evolving, financial industry has readily adopted the technology and developed potential applications for portfolio optimization, risk modelling, NLP, credit card fraud detection, and derivatives pricing, to name a few. The challenges for mass adoption of QCaaS include a) hardware limitations, b) lack of software ecosystems, c) resource constraint with relevant skills, and d) quantum error rate. The scaling up and mass adoption of quantum computing will definitely depend on commercial feasibility to address if a) quantum computing can deliver superior computational accuracy for a given application as we move from Proof of Concept (POC) to production-level solutions and b) superior quantum speed of delivery over classical computing can be justified along with investment in the underlying QCS infrastructure or in the pay-per-shot quantum computing.

Future Work

A few important aspects of future work include a) development of better models for hybrid classical-quantum computing and b) mining of social coding platforms (e.g, GitHub) to adopt best practices from the developers worldwide on QCaaS.

References

1. Raj, A., “Equinox to offer business Quantum Computing as a service,” Tech Wire Asia, 16 Mar 2023, https://techwireasia.com/2023/03/equinix-to-offer-quantum-computing-as-a-service/

2. Castelvecchi, D. “IBM releases first ever 1000 qubit quantum chip,” 04 Dec 2023, https://www.nature.com/articles/d41586-023-03854-1

3. Gambetta, J, “The hardware and software for the era of quantum utility is here,”, https://www.ibm.com/quantum/blog/quantum-roadmap-2033

4. Rietsche, R. et. al, “Quantum Computing,” Electronic Markets (2022) 32:2525–2536, https://doi.org/10.1007/s12525-022-00570-y

5. Ahmad, A. et. al, “Engineering software systems for Quantum Computing as a Service: A mapping study,” https://arxiv.org/pdf/2303.14713.pdf

6. Ahmad, A. et. al, “Towards process centred architecting for Quantum software systems,” 2022 IEEE International Conference on Quantum Software (QSW), 10-16 July 2022, DOI: 10.1109/QSW55613.2022.00019

7. Herman, D.A. et. al, “A survey of Quantum Computing for Finance,” https://arxiv.org/pdf/2201.02773v4.pdf

8. Pistoia, M. et. al, “Quantum Machine Learning for Finance,” https://arxiv.org/pdf/2109.04298.pdf

Views expressed by Dr. Arunkumar M. Sampath, Principal Consultant, Tata Consultancy Services (TCS) in Chennai

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/