A vibrant and well-developed corporate bond market is essential to support economic growth of a country. It provides an alternative source of finance and supplements the banking system to meet requirements of the corporate sector to raise funds for long-term investments. Further it enables companies to tailor their assets and liabilities profiles to reduce the risk of maturity. It also helps in the diversification of risks in the system.

In India, importance to develop the corporate bond market can be gauged from the Government’s focus on infrastructure investments. It is focussing on investments in the infrastructure sector to support economic growth. Government has laid out infrastructure vision 2025 with the announcement of National Infrastructure

Pipeline Investments of INR 111 Lakh Crore over the period of 2020-25. As per the government’s working paper 40 per cent of investments will be supported by the Central Government, 39 per cent by the State Government and 2 per cent is expected from the private sector.

Banking sector has just come out of NPA challenges and its appetite to lend to such assets is constrained. Further, bank’s ability to lend to infrastructure projects is restricted due to shorter dated liability structures. A well-developed corporate bond market can substitute bank lending for long term financing. It will also help long term investors like insurance companies and pension funds to invest in long term assets to match their ALM profile. Hence it supports the government’s infrastructure vision to stimulate economic growth.

Present status of corporate bond market in India

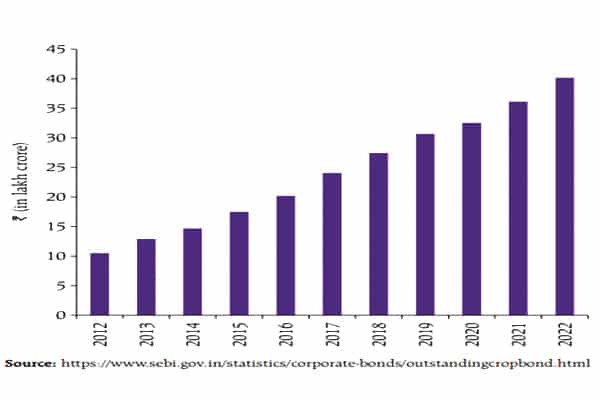

Over the decade regulators have taken many steps to develop the corporate bond market in the country. Regulators have worked on to set up infrastructure and bring regulatory reforms which has resulted in rise-in mobilisation of resources through the corporate bond market. The size of outstanding corporate bonds has increased to INR 40 Lakh Crores in FY2022 from INR 11 Lakh crore in FY2012; indicates impact of reforms undertaken. Further as per CRISIL, Size of outstanding corporate bonds are expected to touch INR 65-70 Lakh Crores in FY 2025.

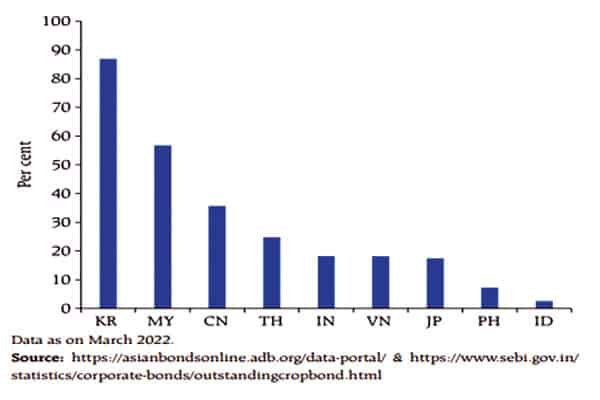

Though in absolute numbers the market has grown substantially, in terms of % of GDP, the size of the corporate bond market is very small, even in comparison with other emerging Asian Markets. This indicates a lot more needs to be done to support and make the market vibrant.

Trading Volumes and Investor& Issuers Participation

Another barometer to check the vibrancy of the market is daily trading volumes and market participation by issuers and investors. As given in the chart, trading volumes are pretty low. This is due to the nature of investors and lack of supplement markets.

Also Read | Central Bank Digital Currency (CBDC) & Its impact on Economy

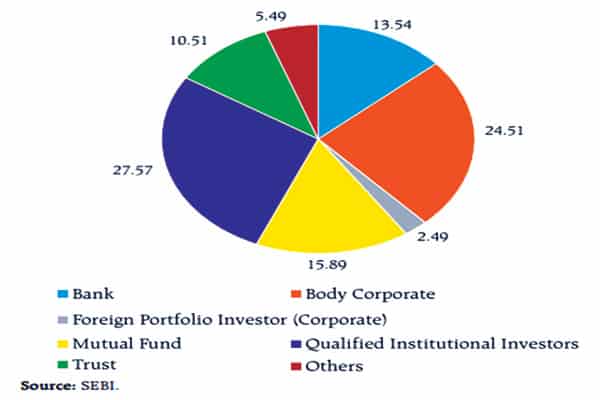

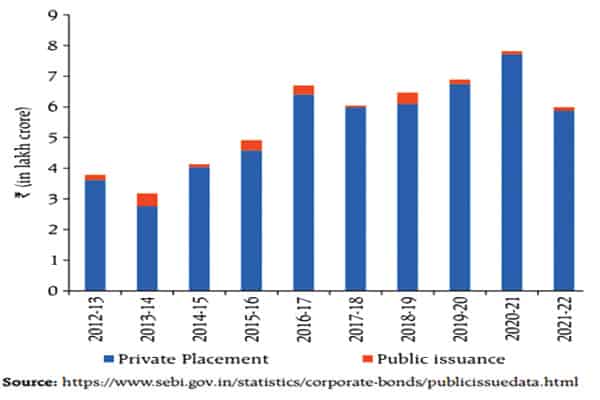

Presently, access to the corporate bond market is restricted to high quality issuers. 80 per cent of corporate bond issuances are by AAA rated entities and 15 per cent are by AA rated entities. This indicates, lack of investors’ appetite for investments in lower rated papers. But if we look at the investors base, we would understand the reason for their skewness toward high quality papers. Investor base constitutes Domestic Institutions. Retail participation, directly or through the mutual funds route is very low. Domestic institutions are highly regulated and not allowed by their respective regulator to participate in lower rated papers. This reduces the appetite for low rated papers in the market. Further, these large institutions by nature have abuy and hold tendency. This has been reflected in the mode of issuance of bonds. Majorly, funds are raised from the participant through private placements.

Another factor for lower trading volume is lack of supplementary markets. Corporate bonds carry market and credit risk. To hedge market risk, India has a well-developed OIS market, but credit derivatives market has not yet picked up. Further, to fund trading positions, functioning of the corporate bond repo market is essential, which has not picked up in the country. Hence investors tend to buy and hold in the market which reduces trading volumes.

Market borrowing Vs bank borrowings

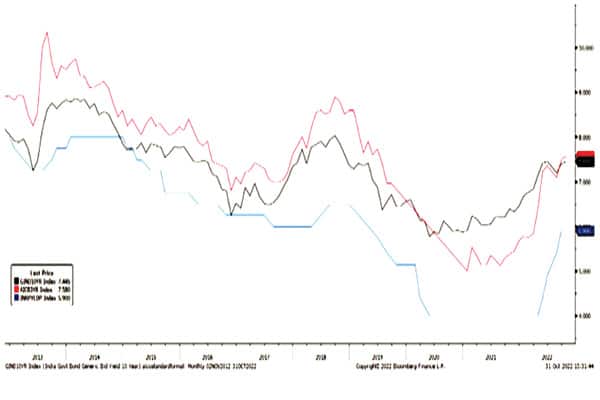

In India, during the rising interest rate scenario, corporates raise funds for their working capital requirement by bank borrowings rather than through market borrowings and vice versa. In rising interest scenarios, market yield rises in anticipation whereas banks’ cost of funds reflect historical cost. Impact of rising interest rates reflects in banks’ cost of funds with the lag. Below graphs confirming the finding as ratio of Non-Food Credits Vs Bonds Issued by non-Financial Entities increases in falling interest rate scenario and vice-versa.

Prerequisite to develop corporate bond market

Development of the corporate bond market is essential to support economic development in India. Though regulators and the government have taken a series of steps to develop and deepen the market, It is still lagging behind even in comparison with emerging Asian peers. I have tried to categorise actions taken or need to be taken to develop the corporate bond market in the graph below.

Without development of complementary markets like CDS and corporate bond REPO, market breadth cannot be broadened. Regulatory changes like rating requirements for investments would allow participation of investors in lower rated papers. Rating mechanism needs to be strengthened. Most important aspect of the market is information asymmetry in the corporate bond market. Disclosure norm should be strengthened to bring transparency. Retail participation should be encouraged through tax incentives equal to investment in equity linked saving schemes and investors’ education about the bond market. India’s infrastructure sector requires huge investments, FPI participation in the securitization market, REITs and InvITs should be encouraged through enhancing NCLT infrastructure and simplifying investment norms.

Views expressed by Harish Madaan, Director, Industrial & Commercial Bank of China.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/