The power of computing has grown exponentially over the years and with this, the significance of Artificial Intelligence (AI) and Machine Learning (ML) also amplified. Since its inception in 1950, the use of AI has percolated into our day–to–day reality and disrupted the way people experience banking and financial services.

The power of computing has grown exponentially over the years and with this, the significance of Artificial Intelligence (AI) and Machine Learning (ML) also amplified. Since its inception in 1950, the use of AI has percolated into our day–to–day reality and disrupted the way people experience banking and financial services.

The HDFC Bank has also envisioned that AI with its disruptive capabilities will revolutionise the way banking services are provided to consumers and it is therefore among the few banks to have used AI to provide various services to customers.

Also, to ride on its prime objective of becoming an “AI – enabled bank of the future”, there are numerous AI initiatives at the bank which are either live or at various stages of development.

These initiatives span across functions like customer service, banking transactions, employee training and engagement, recruitment, operations, analytics and e-commerce, and payments.

The underlying mission of HDFC Bank is to enable AI backed services ranging from commerce to care that can fulfill all the needs of HDFC Bank as well as Non–Bank customers.

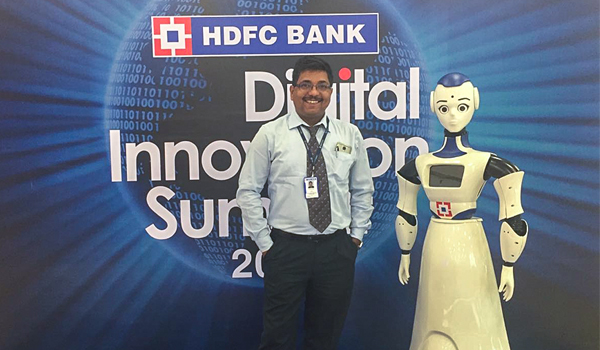

Some of the key AI initiatives which are live include Electronic Virtual Assistant (EVA), Intelligent Robotic Assistant (IRA) – a humanoid robot, Recruit Bot and a social commerce chat bot on Facebook Messenger – HDFC Bank OnChat.

With these solutions, we have been able to enhance the overall user experience of not only HDFC Bank customers but also Non – HDFC Bank customers. Our customer service chat bot – EVA solves over 6 lakh queries on monthly basis saving 20,000+ man hours per month. This engine has helped HDFC Bank to transform our digital customer service channel into a competitive asset.

Innovative AI backed solutions are not limited to only EVA but we have also deployed a one–stop chat bot solution on Facebook Messenger called HDFC Bank OnChat.

Currently, this conversational and interactive platform also has the capability to provide personalised solutions boasts of having 3,00,000+ unique users every month.

It is the first chat bot based e–commerce and payments platform service via Social Media Channel and has been regarded as a ‘Success Story’ by Facebook. Our efforts in channelising AI backed solutions do not end there.

HDFC Bank is also the first bank in India to introduce IRA – a humanoid robot for branch assistance. Launched at HDFC Bank’s branch in Mumbai, IRA services on an average 60 customers on a daily basis.

The robot detects the presence of customers through vision sensors and answers queries/ guides them to the nearest counter. This has not only assisted the branch staff but has also added a delight factor to the customer’s experience at branches.

Another disruptive innovation by HDFC Bank that paved the way for effective recruitment is its Recruit Bot. The recruit bot has the capability to identify the right candidate across functional and personal skill sets and is ideal for large scale recruitment drives.

The solution has helped in reducing the time to hire by up to 80 per cent. Although, we at HDFC Bank have taken a lead in implementing AI enabled solutions, AI being a new technology, will take considerable time to mature. Improvements in AI toward it becoming more natural than ‘artificial’ will help in increasing the overall efficiency and productivity of organisations at reduced costs.

Employees will be trained and helped on how to upgrade their skill sets to make AI a part of our digital DNA. All customer facing roles will be enabled using cognitive customer agents whereas back–end processes will run on advisory bots, process automation bots and expert systems.

Major internal processes that form the backbone of the bank will function on a hybrid model comprising digital and human workforce. As Ray Kurzweil, chief engineer for Google and famous futurist says “AI Will Not Displace Humans, It’s Going to Enhance Us”.

AI will help us manage both internal and external customers much more effectively and help reduce our operational costs exponentially in the near future.

Disclaimer: Views expressed in this article are a personal opinion of Rajnish Khare and in no way any official statement and/or communication of any kind from HDFC Bank

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/