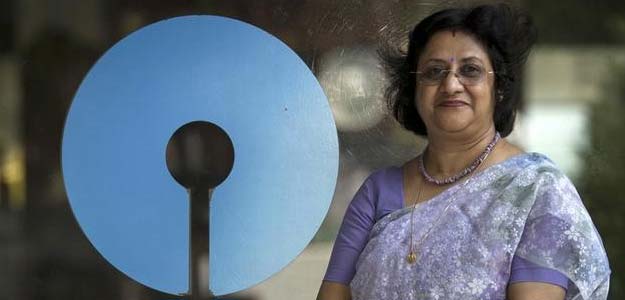

Underscoring the twin importance to maintain credibility and draw foreign capital, SBI Chairman Arundhati Bhattacharya has said banks need to meet regulatory norms as India is a capital deficient country.

Underscoring the twin importance to maintain credibility and draw foreign capital, SBI Chairman Arundhati Bhattacharya has said banks need to meet regulatory norms as India is a capital deficient country.

Speaking during the FICCI Banking Conclave in Kolkata, she said: “Banks in the country are required to maintain things like liquidity coverage ratio (LCR), CRR and SLR and classification of loans also.”

“As India is a capital deficient country there is need to meet these standards and maintain credibility and attract foreign capital.”

She said these were the challenges that the Indian banking industry would face in the wake of globalisation which was not there at least ten years ago.

Stating that now, banks are required to maintain LCR over and above CRR and SLR, the SBI chief said: “Liquidity risk is the biggest risk which the banking sector was facing today.” “It was due to this that the Lehman Brothers of the US collapsed.”

Globally restructured assets were classified as stressed assets.

“In India, restructured assets are classified as standard assets. These are challenges we are to live with and grow with,” Bhattacharya said.

Stating that the State Bank of India has identified seven lakh Pradhan Mantri Jan Dhan Yojana (PMJDY) accounts to avail overdraft from the bank, Bhattacharya said, Cyber crime was another issue of concern among the bankers.

She also said technology was becoming a great enabler in reaching out to the people in villages.

On this, she said SBI was devising small investment products and flexible deposit schemes for those who were banking through the Business Correspondent (BC) model.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/