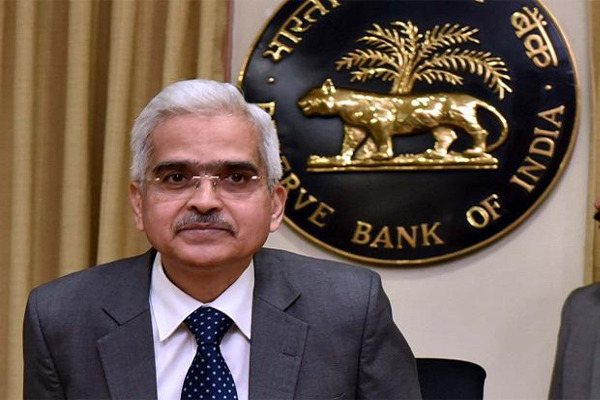

During the Reserve Bank of India’s Monetary Policy Committee today, the Reserve Bank of India (RBI) Governor Shaktikanta Das today decided to keep the repo rate unchanged at 4 percent. RBI’s monetary policy committee voted unanimously to maintain the repo rates intact as they found it necessary to support growth. Repo Rate is key interest rates at which the RBI lends money to commercial banks.

Besides, the Reverse repo rate remains intact at 3.35%, Marginal Standing Facility Rate and Bank Rate at 4.25%, as announced during the RBI MPC. While announcing the monetary policy review Das also maintained the Gross Domestic Product (GDP) at 9.5 percent for FY22.

However, citing inflation concerns, the regulator increased the CPI inflation estimate to 5.7 per cent from 5.1 per cent.

Experts’ reaction to RBI Monetary Policy Committee Annoucements:

Venkatraman Venkateswaran, Group President & CFO, Federal Bank Ltd

The very clear message from RBI comes as a continuation to the commencement of normalisation about a month back. The 10 year bond yields have moved from 6% to 6.20% in the last two months. The extension of the liquidity facility won’t make much of a difference in the present situation, given the fact that banks still have not fully utilised the existing limits. Liquidity thus, is not the matter of concern at this point. Credit off take is still tepid. Accommodating & supporting growth is crucial and so has RBI prioritised growth over inflation. Gradual & steady calibrated liquidity withdrawals would continue.

Vikash Khandelwal, CEO, Eqaro Guarantees

The RBI has been doing the heavy lifting to bring back the economy on track since the pandemic struck last year. It has announced more than 100 measures to support growth. The move to extend TLTRO till December will further aid growth. Over the high-frequency indicators, normal monsoon, and steady pace of vaccination indicates the RBI estimate of 9.5% growth for FY22 is achievable. The decision by the RBI to keep key rates and the unchanged ‘Accomodative’ policy stance was on expected lines. Easy liquidity will help businesses, especially the MSMEs at a time when demand is recovering. The governor has allayed concerns on inflation as well.’’

Manoj Gaur, CMD, Gaurs Group, and Vice President – North, CREDAI National

“The unchanged repo rate decision by the RBI is on the expected lines; the Apex bank maintained the accommodative stance that is the need of the hour. However, the real estate sector has been expecting sector-specific measures that could trigger healthy growth. Although the government has taken some steps to help the sector in recent months, additional reforms are required to allow the sector to thrive. The upcoming festival season will likely bring in more demand, and we are hopeful that the low home loan interest rate will make the buyers go for real estate assets”.

Vikas Wadhawan, Group CFO, Housing.com, Makaan.com and Proptiger.com

On widely expected lines, the RBI on August 6 decided to maintain a status quo on key policy rates. The decision of the RBI MPC augurs well for the real estate industry in general and home buyers in particular, since the record low interest rate regime would enable a large number of buyers to invest in property. Since homebuyer sentiment has already improved in recent times, based on an increase in housing affordability in India, the RBI move will prompt buyers and investors to put their money in secured assets like real estate. The extraordinary liquidity support the RBI has provided to the economy in the aftermath of the coronavirus pandemic is highly commendable.

Also Read: RBI Monetary Policy: Repo rate remains unchanged for the 5th time in a row

Pradeep Aggarwal, Founder & Chairman, Signature Global Group, Chairman, ASSOCHAM, National Council on Real Estate, Housing and Urban Development

We appreciate the apex bank’s continued accommodative stance. Real estate has made a strong demand for low house loan interest rates, and the RBI has helped the sector by maintaining the status quo. We recommend that customers take advantage of the current scenario because, in the future, prices may rise due to higher raw material costs.

Amit Modi, Director, ABA Corp and President Elect CREDAI Western UP

The RBI’s goal is challenging since it must maintain its accommodative stance for as long as it is needed to stimulate and sustain growth and continue to offset the impact of COVID-19 while keeping inflation within the target range. However, no one can deny the importance of the real estate sector and its requirements. The sales are gradually coming back and looking bright, but the sector is expecting measures that could trigger sales in sync with the increased realization of the potentiality of real estate assets.

Deepak Kapoor, Director, Gulshan Group

“Though we were expecting steps to enhance liquidity further, the RBI stance is understandable looking at the current scenario. The sector is going through a phase where people have realized the importance of home ownership, which was evident in our sales figures. However, the sector needs hand-holding, and we hope there will be measures coming up that will help the sector in these challenging times.”

Also Read: RBI Monetary Policy Review: Repo rate remains unchanged at 4%

Nishant Arora, Co-founder and Director, Setup Services India

The extension of the On-tap TLTRO scheme will aid the MSME sector to contribute towards the healthy GDP prediction of the Apex bank. The RBI continued its accommodative stance that reflects the realization of maintaining policies to enhance spending and manufacturing. We have to understand that the startups and MSMEs are turning out to be the backbones of the economy, and the constant government support to these segments sends optimistic signals.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/