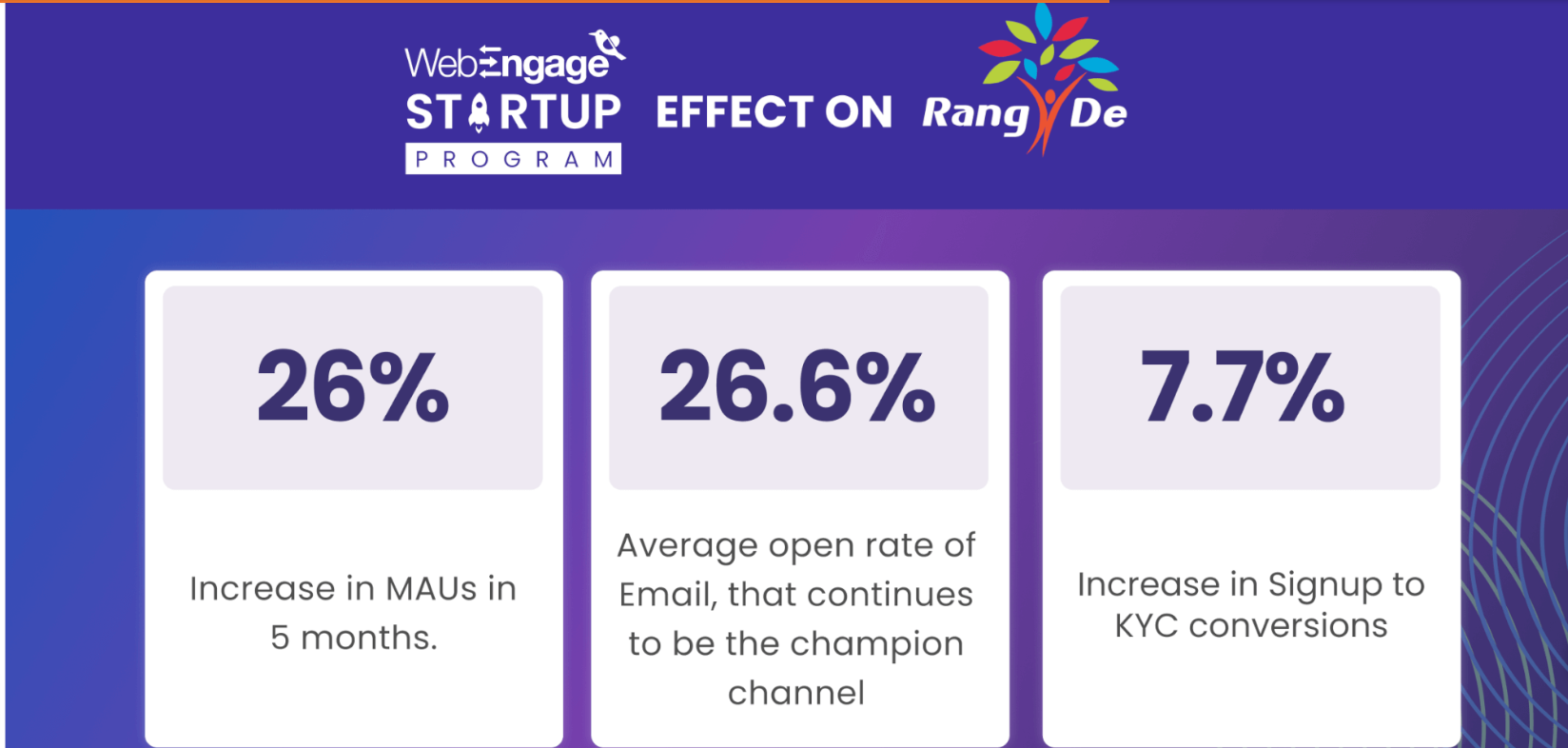

In the ever-evolving world of fintech, staying ahead of the curve is paramount. The story of RangDe, India’s groundbreaking peer-to-peer lending platform, showcases the transformative power of targeted technology. Within a span of five months, they registered a remarkable 26 per cent surge in their Monthly Active Users (MAU), thanks to a strategic partnership with WebEngage. Delve into the intricacies of RangDe’s operations, their set objectives, the challenges they faced, and the pivotal role WebEngage played in redefining their user engagement strategy.

Ramakrishna, Co-founder & MD, RangDe stated, “With the WebEngage Startup Program, we’ve quickly chased our north-star metric – a holistic user experience. Giving us the growth spurt we wanted, WebEngage has been instrumental in helping us experiment and optimize data across channels.”

About RangDe:

RangDe, India’s first and pioneering social peer-to-peer (P2P) lending platform, aims to revolutionise credit access and enable financial inclusion for every individual in India.

Rang De utilises technology, human resources, and design thinking to create an efficient and user-friendly platform for credit accessibility and social investment. The platform is designed to make credit affordable for investees (borrowers) and enhance the investment experience for social investors (lenders).

Rang De operates within the peer-to-peer lending space, offering a digital platform for individuals and micro-entities in India, like farmers, artisans, and small business owners, who are typically excluded from formal financial institutions. The platform provides low-interest loans, thus promoting economic growth and income generation, and aims to promote sustainable growth for enterprises and investees by providing access to low-cost credit.

Objectives:

Support team based:

- An easy-to-use, robust solution for promotional and customer service emails

- Setting up user journeys and funnels to reactivate lapsed/inactive users

- Setting up segments according to demographic and behavioral data

Marketing and growth based:

- Need for high user retention through content marketing through channels like email and web/app content

- Personalisation of a high degree for marketing communication to user segments

- Tracking the success of marketing and growth efforts aimed at the existing user base

- Driving engagement through targeted communication

Product based:

- Tracking high-level as well as granular analytics of products as per a variety of events set up

- Triggering funnels and journeys according to the usage trend of the product

- Setting up and tracking user cohorts and analysing their interactions with the product

- Need for secure setups across data and processes

Challenges:

- Inability to attract sufficient users to the platform

- Getting users who are dropping off the platform to complete their KYC & initiate repeat purchases

- Converting maximum registrations into social investors

- Automate user engagement initiatives

- Retain existing social investors

- Lack of an advanced and real-time user segmentation

Results?

To know more about how RangDe managed to achieve their objectives, download the case study.

To begin your journey with WebEngage’s Startup Program, take a demo now.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/