Capital markets have undergone a sea of change in the past decade. The current pandemic has further aggravated the need for risk-proof services to meet the evolving customer demands. Robotic Process Automation (RPA) adoption worldwide is staggering, transforming manual processes.

In general, banking and financial institutions are getting entrenched in RPA because the software bots reduce manual efforts, which is one of the significant benefits. According to Grand View Research, the global market size of RPA in the banking, financial services, and insurance (BFSI) sector was expected to reach a CAGR of 31.3% from 2019 to 2025.

How Can RPA Benefit?

Implementing RPA enables businesses to use legacy and new data to bridge the gap that exists between processes. RPA, being lightweight, integrates with the existing IT infrastructure, allowing enterprises to operate faster, with the highest accuracy levels, and make the best use of available resources for business growth; they reduce the need for large-scale projects and associated investment needs.

Also Read: IDBI Bank, U GRO Capital partner to offer co-lending agreement

Several successful RPA implementations indicate a 60 to 80% reduction in manual efforts in certain use cases. Similarly, in capital markets, automating manual tasks in both trade and customer lifecycle can enable people to take up higher-value tasks like improving and adding value to customer experience.

Key Areas where RPA Can Transform Capital Markets

There are several middle and back-end processes that require automation with cognitive RPA. Combining AI and ML takes the technology a few steps ahead of mere rule-based automation. It’s intelligent because it learns and evolves over time.

Compliance

Compliance is considered one of the critical areas of focus for financial institutions to avoid fines and have risk-proof operations. Enabling RPA automates compliance control, monitoring, and reporting processes, improving efficiency and agility to scale as per need.

Apart from generating detailed logs of automated processes in the form of reports for quick review, software bots are easy to reconfigure, making the process change faster and easier to accommodate new regulations. Currently, an average financial firm’s expenditure on KYC, customer due diligence (CDD), and client onboarding comes to US$60 million per year, according to the 2016 Know Your Customer Survey by Thomson Reuters. Enabling automation reduces the process handling time, optimizes data extractions from various sources, and standardizes the processes.

Trade settlement

Highly time-sensitive and volume-driven processes like clearing and settlement in financial markets can benefit from automation. Implementation of RPA enables enterprises to ensure accuracy while eliminating operational risks.

Since implementation stages are highly flexible, institutions can manage high volumes of services that respond to diverse requirements. Additionally, RPA implementation allows enterprises to focus on innovative strategies to grow business and improve existing services.

Communication & Reporting

In Financial Markets, where accuracy, timeliness, and reliability are critical, RPA can be relied upon to enhance the accuracy in reporting. Yet, another significant advantage is that the platform maintains an audit trail for each step in the process, useful for audit and regulatory requirements.

One of the superpowers of RPA is that it can extract data from various sources to collate accurate reports in several formats. Right from the stakeholders to clients, reporting can be automated and standardized.

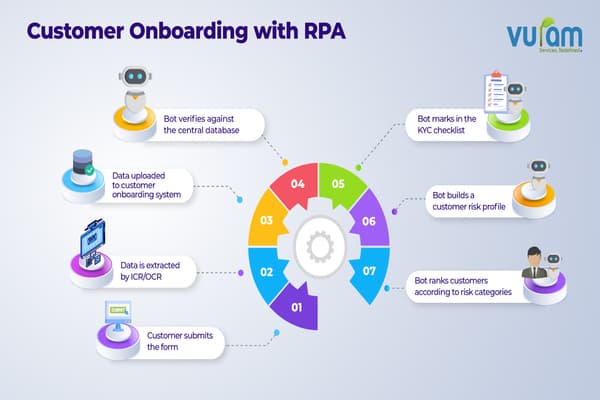

Customer onboarding

By nurturing excellent customer relationships, RPA can transform onboarding into delightful and hassle-free digital experience. Leading RPA platforms like UiPath (Document Understanding), BluePrism (Decipher IDP) have their own document understanding frameworks.

This comes as a blessing in a document-intensive area like the KYC. Massive effort goes into document verification, assessing, flagging, and monitoring risks. With RPA, we are not looking at just automating tasks; RPA integrated with AI and ML capabilities can give a facelift to the entire process:

● Data from the physical documents submitted by the customer is extracted with ICR and OCR technologies; the data is populated into digital forms and sent to customer onboarding systems.

● By verifying the details against the bank’s central database using bots, vast data could be compared, delivering a faster turnaround time. By defining the rules, the bots can even check the verified document against the KYC checklist.

● Bots can extract details from sources like—credit scores, data from legacy systems, and local government websites to verify the integrity of the information and consolidate a customer risk profile.

● The ML capabilities will enable categorizing the customers according to the risk categories. The bot can also mark up customers with high credit risk so that the bank staff knows they need not pitch their offerings.

Capital Market firms are replete with processes that can derive value from automation through bots. Processing high volumes of data with accuracy is critical to maximize profitability and stay competitive in evolving capital markets which are quick to adopt supporting technologies to leverage advantages.

Also Read: U GRO Capital and Kinara Capital ink co-origination partnership

For capital market firms, resorting to RPA is a tactical solution to achieve cost reduction and higher efficiency by replacing legacy systems. RPA allows replacing these legacy systems in a timely and cost-effective manner with minimal investments.

While redefining the value chains across industries, producing greater efficiency, and improving user experience, RPA will transform the future of BFSI and undoubtedly redefine the workforce. Organizations with strong expertise in delivering Robotic Process Automation services and solutions, like Vuram, can integrate RPA into core operations to transform the entire business ecosystem.

About Rajeshwaran Ramaswamy

Rajeshwaran Ramaswamy, Technical Delivery Manager at Vuram has more than 17 years of experience in leading delivering teams and driving digital transformation initiatives for client engagements across different domains. He has good expertise in end-to-end Automation Life Cycle implementation with RPA, OCR, and Analytics platforms.

Views expressed in this article are the personal opinion of Rajeshwaran Ramaswamy, Technical Delivery Manager at Vuram.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/