Technological transformation has not left any sector unchanged across the globe. Emerging technologies such as artificial intelligence, blockchain, cyber security and data analytics form the ABCDs of this brave new world. The banking, financial services and insurance sector (BFSI) has seen maximum adoption of these new-age technologies, making it an attractive proposition for employment. It is to the jobs landscape what IT has traditionally been for India.

BFSI in India gets the FinTech touch

According to the National Skill Development Corporation (NSDC), the BFSI sector in India will require an extra 1.6 million skilled workforce, come 2022.

So, what has been driving this growth in the BFSI sector? Business innovation and technology are two answers. These trends have seen an uptick because of the rise of FinTech and its high adoption rate in India.

The term FinTech is used to describe a range of financial technologies that banks and financial institutions use for operational efficiencies and superior customer experience. FinTech is largely responsible for transforming the BFSI sector into an attractive proposition for job seekers and investors as well. FinTech in India has also received adequate fillip from the government’s pro-digitisation policies.

BFSI gets an AI thrust

One of the technologies that has led to the digitisation of BFSI sector is artificial intelligence. A slew of Indian banks have been using AI-based chatbots for CX-related tasks. Most of these bots can answer consumer-related queries in real-time, thus saving agent time, and freeing them up for other aspects of the business. Banks and FIs are also increasingly using robotic process automation or RPA. This technology helps them boost customer experience, lower operational costs and errors. Turnaround times on tasks such as opening accounts, processing claims or even closing accounts come down drastically. Robotic process automation boosts productivity and takes away many repetitive manual tasks. Many back-office operational jobs are gradually being done away with because of RPA proliferation. The rise of AI has meant that candidates who wish to enter the BFSI sector need proficiency in it. It is important that existing workforce also upskill themselves in AI to stay relevant in the BFSI landscape.

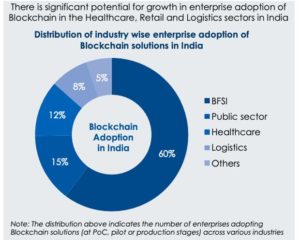

Another technology that is being adopted in the BFSI sector is blockchain. Banks across the globe and in India as well are taking to blockchain technology — these include well-known names such as Kotak Mahindra, ICICI Bank, Yes Bank, HSBC, BNP Paribas, Axis Bank, JP Morgan and Bank of China. They are or have tied up with blockchain companies to speed up settlements, payments across borders, and all transactions in general. Also, blockchain is useful for banks because it secures data and records, and boost fraud detection. A good blockchain application would be in the realm of know-your-customer (KYC). With the use of blockchain, banks can help other banks/FIs to access a client’s verified KYC data, thereby reducing duplication in efforts. With so many advantages, it is but natural for the BFSI sector to adopt blockchain. The demand for talent in this area is also proportionately rising. According to a 2018 Nasscom-Avasant report, the demand for blockchain talent is is growing at over 40 per cent per quarter.

(Infographic source: NASSCOM Avasant India Blockchain Report 2019)

As the BFSI sector in India continues on its path of technology adoption and digital transformation, the question of cyber security comes up. More banks and FIs have started to put in place measures that ensure the security of customer and organisational data. Without cyber security, banks are vulnerable to breaches of data, leading to not just loss of trust from customers but also money and time. When there’s a breach of data, many customers may seek redressal — they may want to block or cancel their cards, check their bank statements and need reassurances from the bank. This in turn means banks would have to allocate additional resources to address customer grievances, thereby losing important time and manpower. Adoption of cyber security programs would ensure fraud and data breaches don’t occur, and customer trust is intact.

Even education services organisations have recognised the growing need for workforces and candidates in the BFSI sector to learn new skills in emerging technologies, and has introduced programs to this effect. These program impart hands-on training and simulation-based learning, wherein students will learn to detect and check any potential breach as part of the curriculum.

Considering a NASSCOM estimate that says India will need a million professionals with expertise in cyber security by 2021, it is imperative that students and the current workforce equip themselves with knowledge on the subject.

Data analytics is another key area in the banking and financial services sector. It helps financial institutions target customers, segment their audience and gain key insights on customer behaviour and pain points. Analytics also help institutions track employee satisfaction and behaviour and empower them to perform better and serve customer needs. Areas like risk and compliance can also get a boost from analytics. Anyone looking to work in the BFSI sector or is already working needs to update their knowledge in the area because of the number of financial institutions and banks using it for operational efficiency. Data science boot camps over the short-term, post-graduate one-year diploma in data science and other programs in data science and machine learning are courses candidates can take up. Even the current workforce can upskill themselves with these courses to stay on course in the BFSI sector.

According to an EY Future of Jobs report, by 2022, about 25 per cent of today’s jobs in the BFSI sector will vanish, while 15-20 per cent of workforce in the sector will be employed in new roles. Companies and educational institutions would need to focus on upskilling and reskilling their workforce to meet these new job profiles. Some of the new job roles include cyber security specialist, credit analyst, blockchain architect and robot programmer.

Summing up, it is crucial that companies, educational service organisations and institutions, apart from students need to work for a future of new roles and new competencies. The BFSI sector is one sector that is proving to be an attractive one for both investors, start-ups and the talent pool in India.

Views expressed in this article are the personal opinion of Robin Bhowmik, Chief Business Officer, Manipal Global Academy of BFSI.

Elets The Banking and Finance Post Magazine has carved out a niche for itself in the crowded market with exclusive & unique content. Get in-depth insights on trend-setting innovations & transformation in the BFSI sector. Best offers for Print + Digital issues! Subscribe here➔ www.eletsonline.com/subscription/